1. juli 2022

Value - a key driver of credit returns

The Corporate Credit Team

Investing with a focus on value rather than index weightings over the longer term, allows disciplined investors to capture higher yields without compromising risk-return metrics.

Key takeaways

- Tracking a credit index rarely leads to outperformance

- A value approach invests in undervalued bonds and avoid those that are overvalued

- A portfolio constructed with a value bias has higher volatility than the market, but outperformance over time more than compensates for this

- We use fundamental research on top of the value signal to avoid the most levered companies and thus keep defaults levels low

In our previous note “How we define value in credit markets” we explained that value investing across the global high yield market was not simply a process of buying the highest yielding credits. Such an approach would result in very high levels of default and would risk exposing investors to permanent loss of capital. For us value is defined by reference to a bond’s fair value curve. If a bond trades above its fair value curve (has a wider spread) such a bond would be defined as undervalued, whereas one which trades below would be classified as overvalued.

As a value investor, we want to invest in bonds where the spread overestimates the risk of default and the issuer’s balance sheet is not excessively leveraged. A portfolio constructed on this basis will usually look very different from a portfolio where the allocations are defined by index weightings.

Why has a portfolio constructed on this basis consistently outperformed the more traditional index orientated approach? A growing body of practitioner research (including our own in-house research) shows the importance of the value premium as a driver of returns. An index orientated approach defines allocations based on a market cap. weighted basis, whereas a value approach allocates based on the most attractive undervalued bonds.

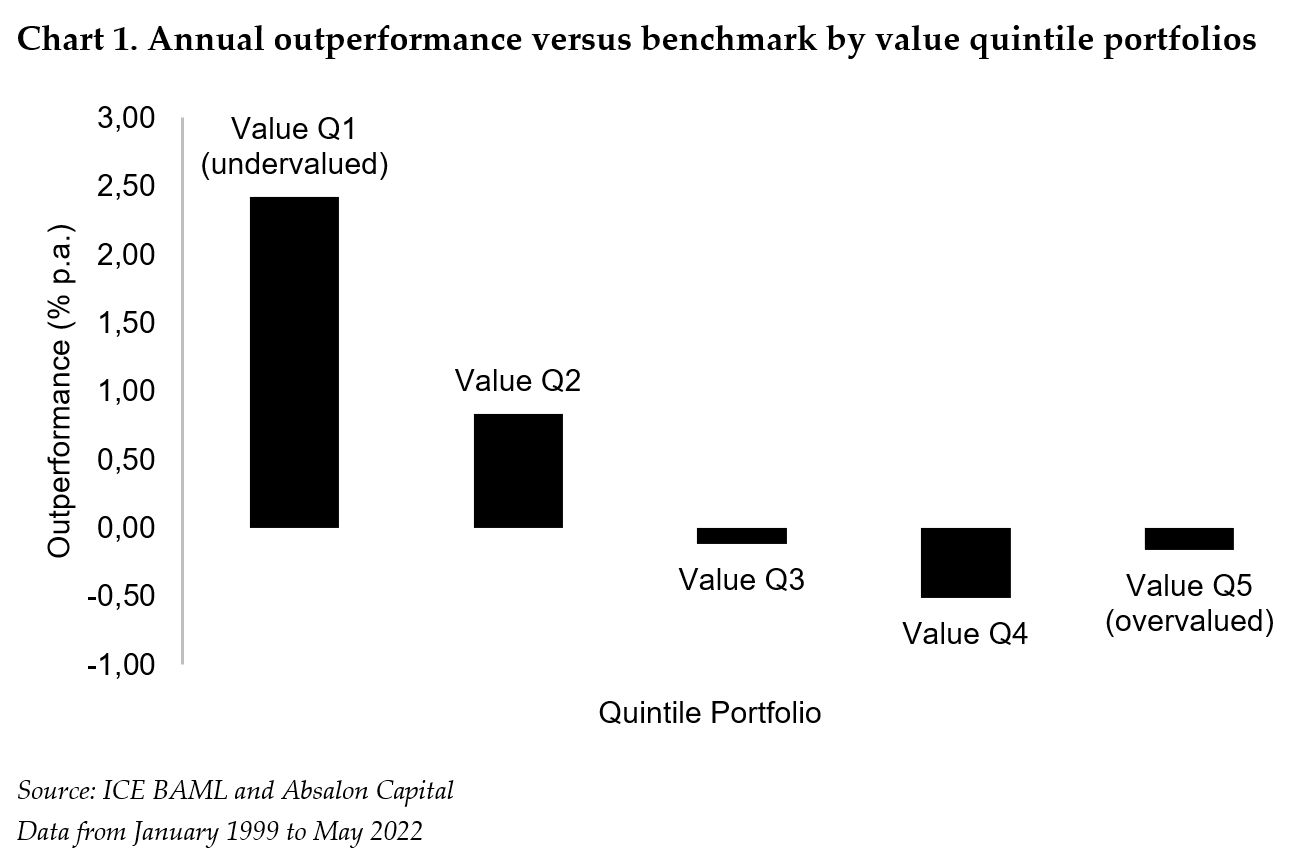

The chart below provides some long-term perspective. It is based on the ICE BAML Global HY index (HW00) and shows the outperformance relative to the overall market based on the value signal and split into quintiles. See our previous note "Absalon Global High Yield" for more information on our factor study. The quintile factor portfolios are rebalanced on a monthly basis. Thus, for each month the Q1 portfolio will contain the 20% index bonds with the highest value factor score.

It is important to stress that the outperformance from undervalued credits captured in this chart is not simply selecting bonds with the widest spread. Each quintile is made up of bonds across the rating spectrum since it is capturing the relative under or over valuation of each bond relative to its fair value curve.

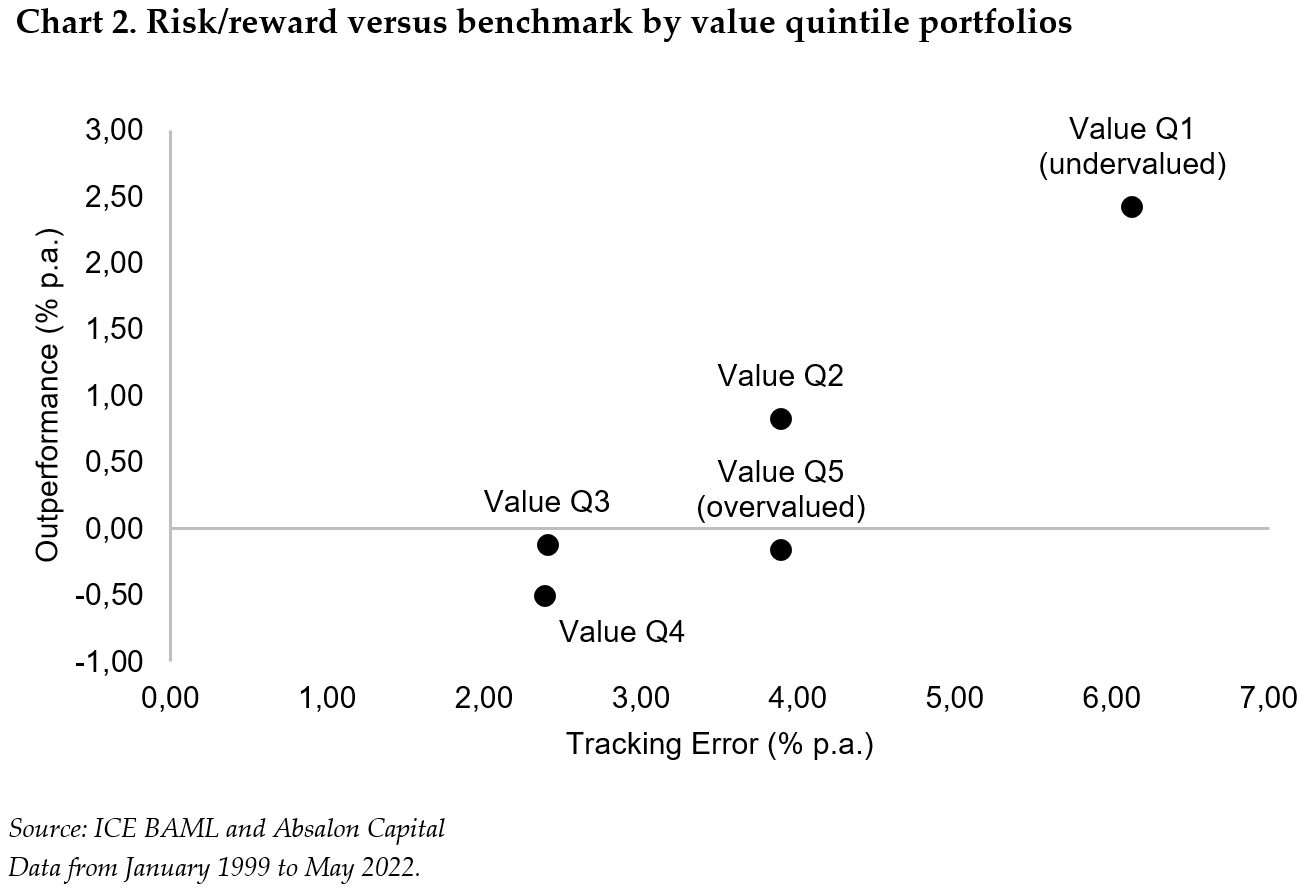

When adding tracking error to the picture, in chart 2 below, the value approach does clearly come with a higher level of volatility. However, if you look at the lower volatilty and more overvalued portfolios (quintiles 3-5) they do not produce any outperformance over time. The point here is that while value is more volatile on an absolute basis the reward from stronger outperformance over time actually results in better information ratios. It also shows that managers need to be quite selective to get the full benefits of a value approach.

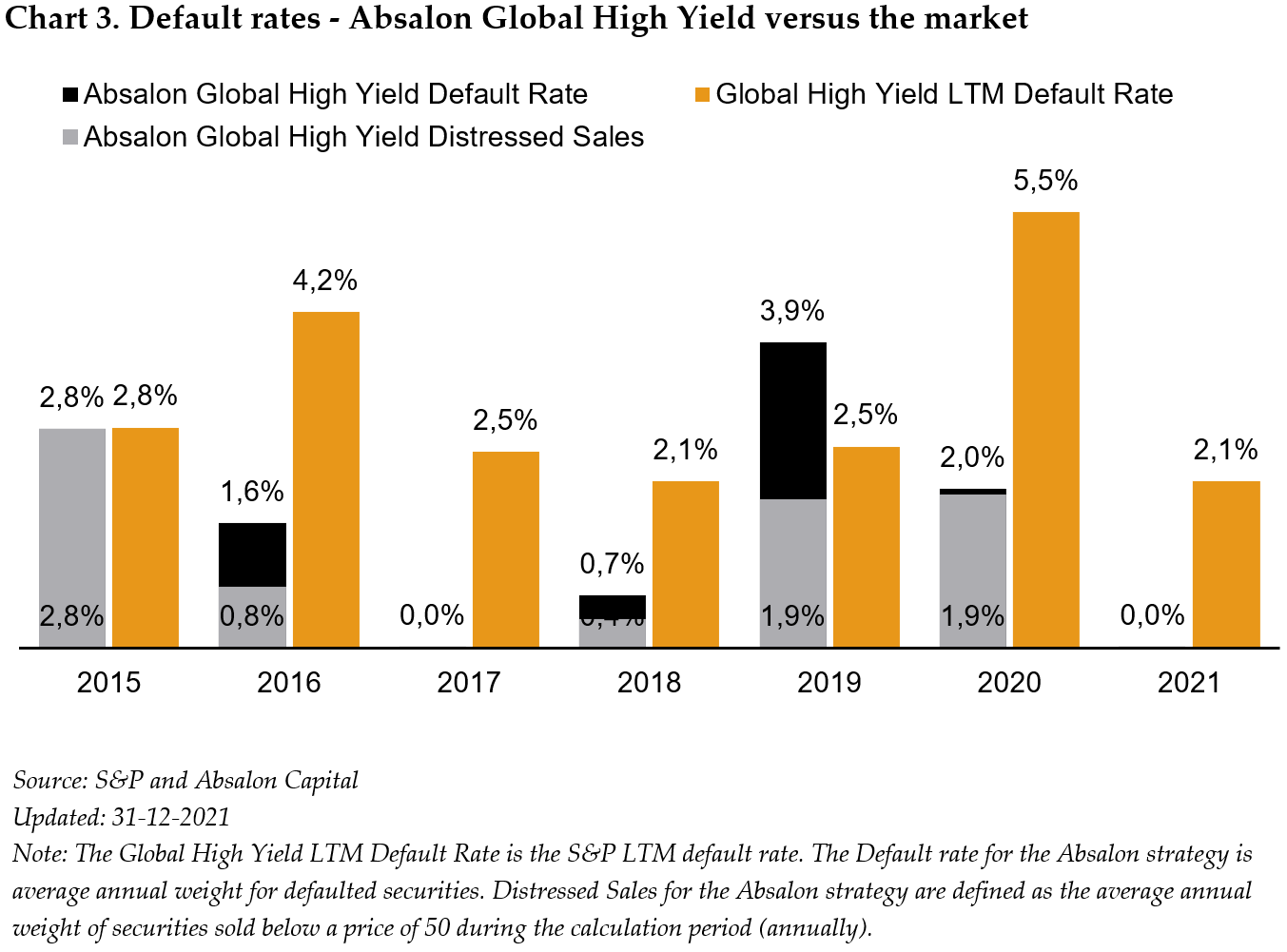

As an unconstrained long-term manager, we prefer to look at risk in terms of permanent loss of capital from elevated levels of defaults. We use bottom-up fundamental research to avoid investing in highly leveraged companies without proper financial flexibility to withstand a downturn in business cycles. We also avoid the lowest rated credits (CCC) which are by far the most default prone when looking at history. For the past 15 years of managing our strategy we have been able to capture the higher spread available from undervalued and out of favour credits without suffering capital loss from higher levels of default. The chart below shows the strategy’s recent default history relative to the market. To be completely transparent, we have also included distressed sales (sales we have made at a price below 50 during the calculation period).

Conclusion

A value approach in credit investing comes with higher levels of tracking error which results from the higher volatility associated with investing in bonds which are considered out of favour or from less well covered areas of the market, including smaller issuers. However, for long term investors we believe that a value approach, which avoids excessively leveraged companies and the most default prone areas of the market, will continue to generate attractive excess returns. But investors must be selective and need to run a more concentrated portfolio to get the full benefits of the value approach. This has been at the heart of our strategy at Absalon since inception.