4. maj 2022

How we define value in credit markets

By The Corporate Credit Team

The concept of value investing is well understood in equities but often misunderstood in credit markets. In equities value is often considered in absolute terms; in credit markets value is commonly viewed in relative terms. An undervalued bond is one that trades at a wider spread relative to similar rated bonds.

Key takeaways

- Value is not simply defined as buying bonds with the widest spreads

- Most long only credit managers have little exposure to value

- Value investing in credit markets should be focused on avoiding over valuedbonds as well as identifying undervalued opportunities

- Value often clusters in sectors and geographies – having the flexibility to exploitthese anomalies is key to strong excess returns

- Value investing in credit markets comes with increased volatility, but thisadditional volatility has been well rewarded over many different credit cycles

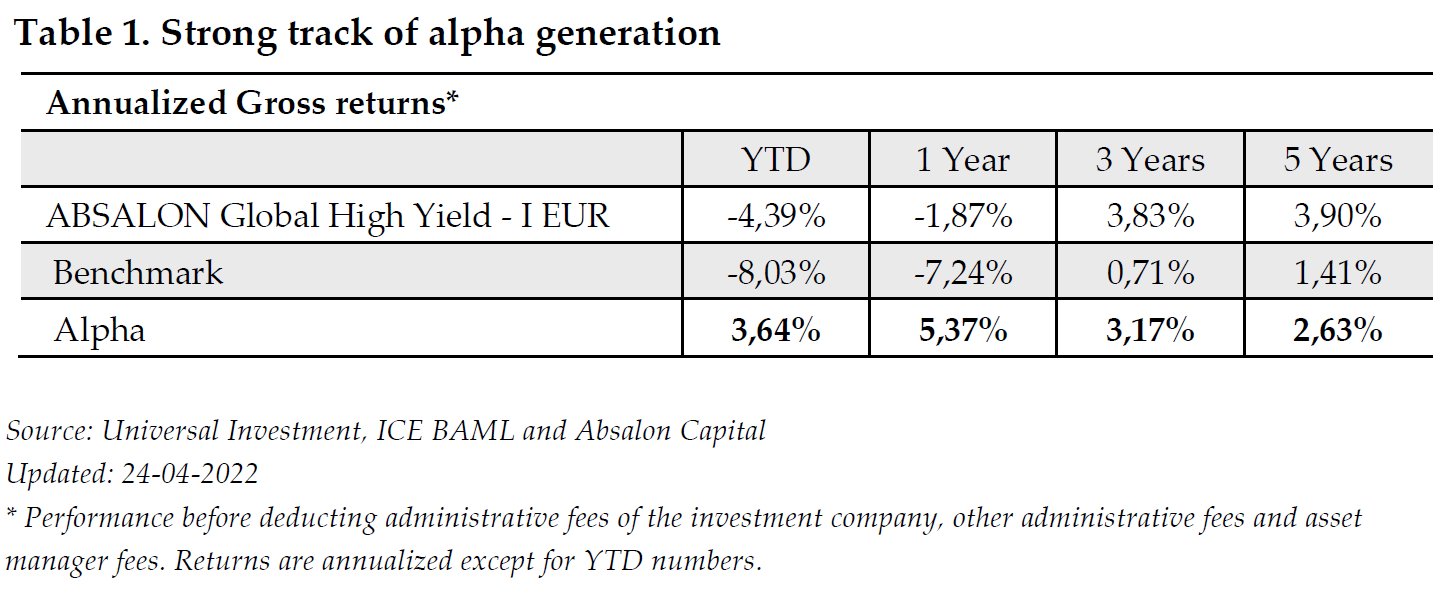

- Absalon Global High Yield has a strong track record of alpha generation fromvalue investing historically

Value investing is a well understood approach to equity investing. The classic value manager seeks out companies where the current share price trades at a discount to the expected future cash flows or the intrinsic value of the business. In equities value is most often considered in absolute terms.

In contrast, when investing in credit markets, value is viewed in relative terms. A bond can trade “cheap” to a similar bond with the same rating. As a value manager we are not simply looking for the bonds with the highest spread; such an approach would clearly expose us to extreme default risk. When we consider value in our investment process what we are referring to is relative value. We are looking for bonds that trade “cheap” to their fair value curve. A fair value curve is constructed using cross sectional regression analysis to fit individual bonds spreads as a function of time to maturity. The fair value curve allows us to compare bonds with a similar credit quality across maturities. A bond which trades above the curve (has a wider spread) would be described as trading undervalued, while one trading below the line (has a narrower spread) would be deemed expensive or overvalued.

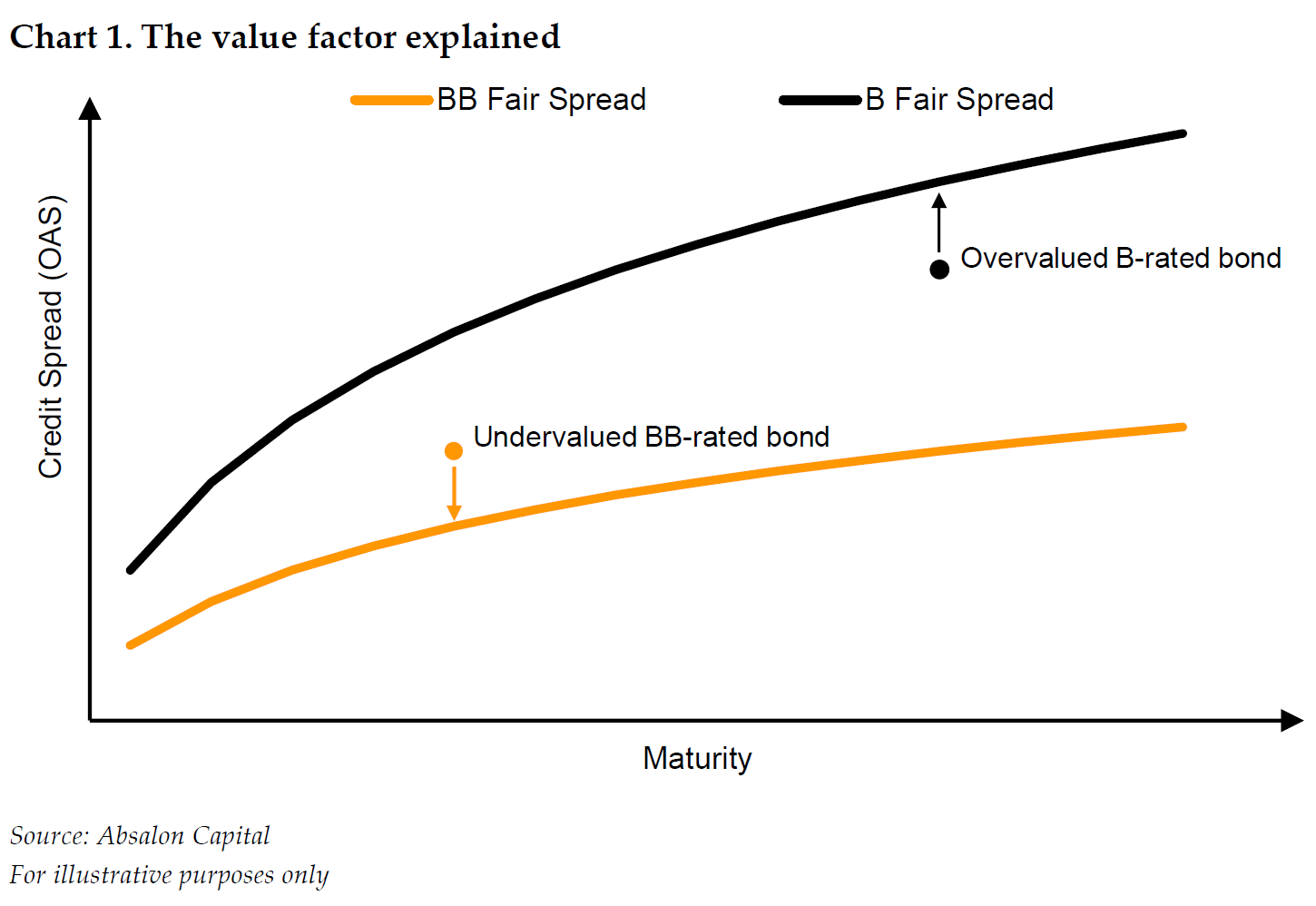

In the very simplified example below we show two bonds with different ratings and different maturity dates. The lower rated B bond offers a more attractive spread compared to the higher quality BB bond. The B rated bond trades below its fair value curve and is therefore relatively expensive when compared to similar B rated bonds.

On the other hand, the BB rated bond trades above its fair value curve and is undervalued. This bond would potentially be regarded as a candidate for further research. Based on fundamental bottom-up analysis, our team would seek to understand why the bond is trading cheap to similar rated bonds. It might be the case that the bond is in an out of favor sector or geography. Since most managers prefer bonds with low volatility, the market will likely overstate the risk of default in those bonds providing attractive opportunities for value investors such as ourselves.

As a value manager we focus on investing in undervalued bonds. We are long term investors, and we define risk in terms of the potential for a permanent loss of capital, not by measuring our tracking error to an index. It should be noted that the average default rate in our portfolio has been consistently below the market since launch. For us a “value bond” is a bond where the issuer is forced to pay a higher spread relative to bonds of similar credit quality either because it is under-researched or out of favor in the broader market, thus overstating the potential risk of default and permanent loss of capital. An important distinction: The average manager will often buy overvalued bonds to manage tracking error and reduce volatility. For us, the starting point is valuation – if the bond is not attractively priced (undervalued), it is not a candidate for our portfolio.

In practical terms because we are not constrained by index weightings, we can also invest in bonds with an investment grade rating. This allows us to capture attractively priced bonds which trade at a discount to their fair value curve away from the standard high yield space. A good example is in the case of “Fallen Angels”. These are bonds which lose their investment grade rating – sometimes due to large macro shocks such as COVID-19. The spread on these companies often spikes prior to the official downgrade announcement, offering an excellent entry point for high yield investors.

To be a successful value investor across credit markets a manager must accept that the approach is capacity constrained. Managing a large asset base across a highly diversified portfolio of 300-400 names makes active management more of a challenge and means that smaller less well covered opportunities contribute less and less to portfolio returns. This explains why we prefer to invest with conviction in a portfolio of 75-125 names.

We think the long-term numbers speak for themselves!

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.