20. februar 2021

Absalon Global High Yield

By The Corporate Credit Team

Superior long term returns through systematic investing in Value and Size.

Key takeaways

- Research shows that a focus on systematic factors in credit markets increases the probability of outperformance over time

- The Value and Size factors will produce larger drawdowns during a market selloff, but these are more than compensated for by the subsequent upside capture

- Our focus on bottom-up selection of undervalued credits while avoiding permanent loss of capital underpinned the strong recovery of the strategy in 2020 and the beginning of 2021

- Value and Size factors have strong potential for outperformance in the first 12- 18 months following a market selloff

- Our 15 years of experience using Value and Size factors as the cornerstone of our portfolios has consistently demonstrated outperformance relative to the market and peers

- Absalon GHY has delivered an annual alpha of 1.3% since launch in 2006 and 2.7% over the past 5 years compared to the ICE BAML Global High Yield Index (Alpha based on gross return versus ICE BAML Global High Yield. EUR Hedged)

Factor investing in credits

At Absalon Capital we believe in active and systematic long-term investing. We have focused on the Value and Size factors for the past 15 years. Our experience tells us that returns from systematic bottom-up credit selection, over a 3-5-year investment horizon has a very high likelihood of outperforming both our peers and the overall market. This is in large part explained by the almost exclusive use of capitalization weighted indices which draws investors in passive funds towards the largest issuers of debt.

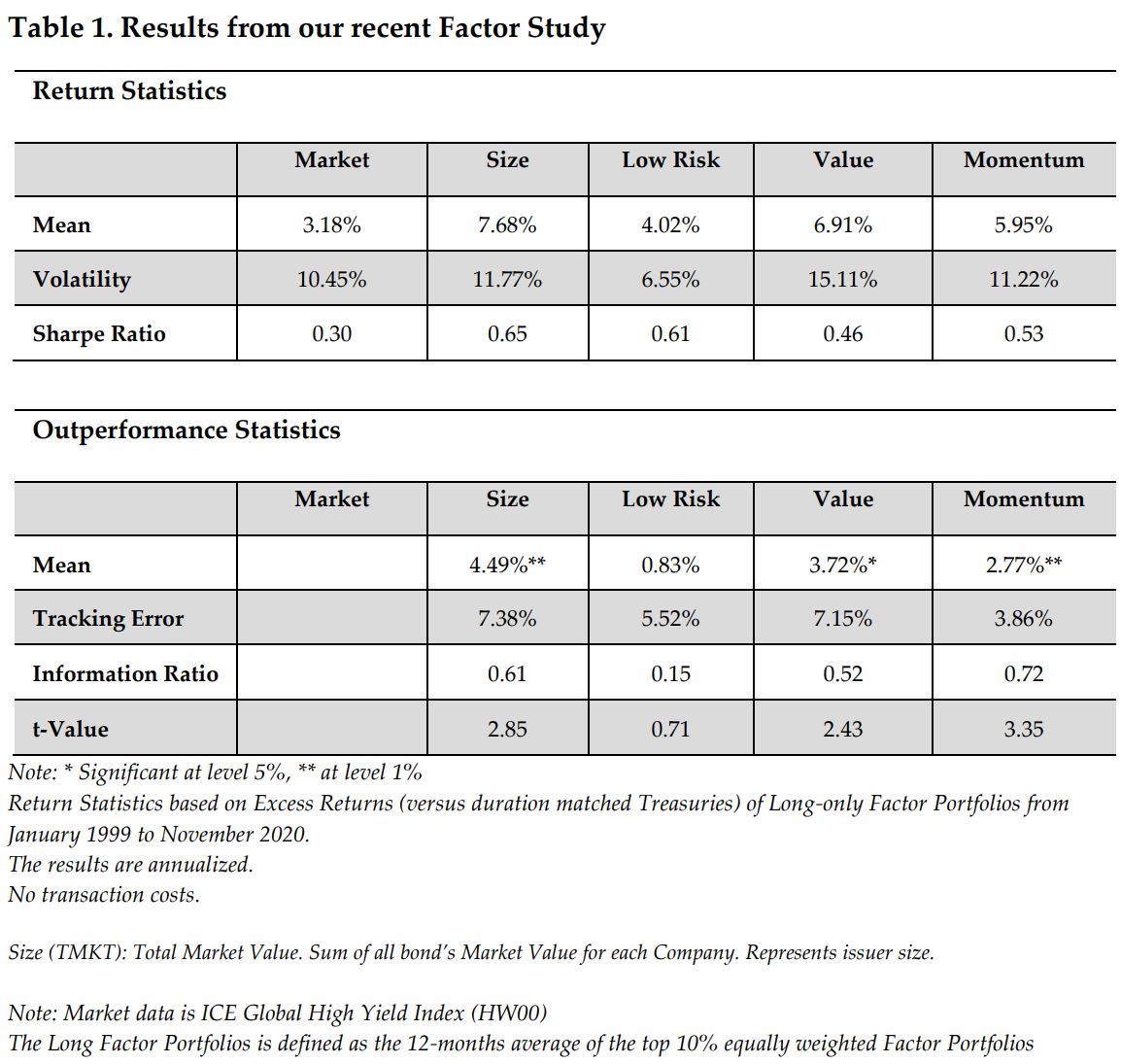

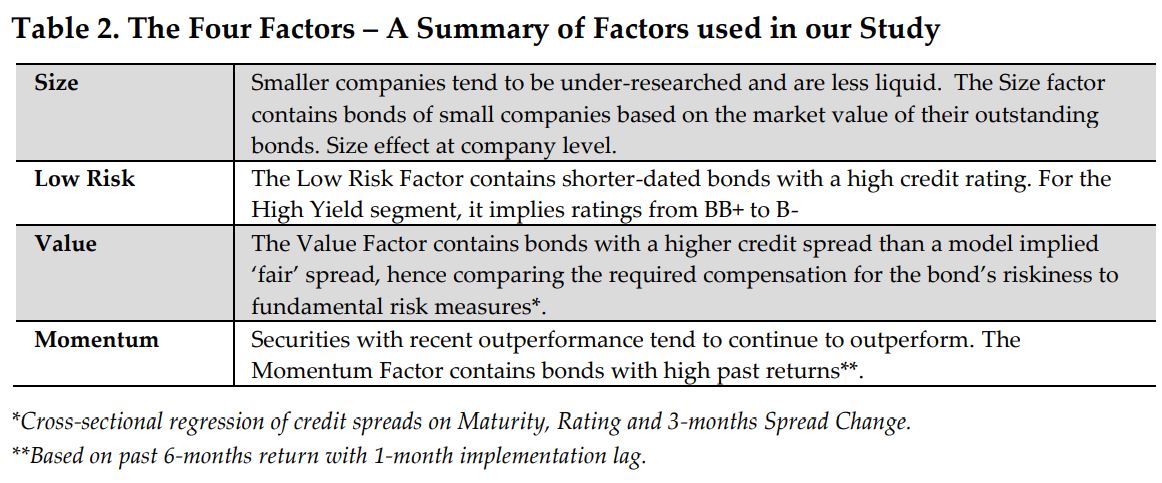

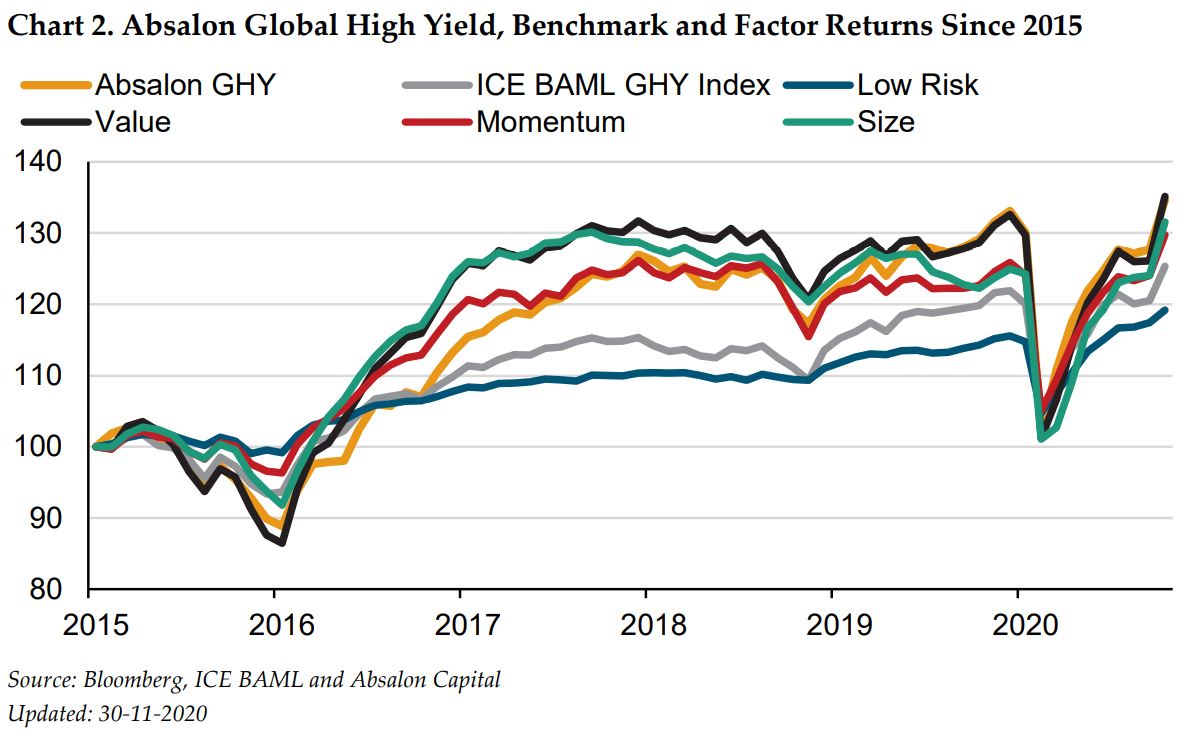

Research focused on Factor Investing in corporate credit markets has grown significantly in recent years. Important contributions include Houweling (2018, 2019), Parker & Rosenberg (2019), Kauf mann, Messow, Fang-Klingler (2020). These studies show that Size, Value, Momentum and Low Risk all outperform the market over time. Size and Value are the most rewarded factors, but they come with higher volatility than the market. Our quant team at Absalon has recently conducted a similar factor-based study, which confirms these earlier findings (see table below).

Analyzing the time varying performance of these factors, we find that Value and Size tend to have larger drawdowns around recessions compared to the market but capture a far higher percentage of the subsequent upside.

Why we use Value and Size at Absalon

When we launched our strategy in 2006 research on Factor Investing in credit markets was almost nonexistent. Our starting point was an article in the Journal of Finance by Martin Gruber published in 2001, which provided a possible explanation to why credit spreads historically overcompensate credit investors for taking default risk. Gruber showed that Value and Size effects could explain a large part of this. Since then, more factors have been proposed such as Momentum, Low Risk, and others – all in their own right with the ability to beat the market if applied consistently. However, we have remained focused on the Value and Size factors because they, in addition to

generating high returns, are also appealing from a fundamental viewpoint. While we acknowledge that momentum exist in credit, it is in our view not an appealing argument to buy a bond just because it has performed well historically. With Low Risk the argument is perhaps more plausible, however the relatively low excess return compared to the market is too small to cover the cost of active management we believe – when also considering transaction costs, there is only a small gain relative to a passive approach.

Investing in the “Value factor” entails more than just choosing the highest spreading bonds in the universe. On the contrary, the most attractive Value factor portfolio might well consist of mispriced crossover credits often referred to as fallen angels. Following a downgrade to high yield, investment grade funds become forced sellers of fallen angels and the bonds experience a spread widening which often overshoots their fundamental value.

The Illustration above shows an undervalued bond relative to its fair credit spread based on its credit rating and maturity, and an overvalued bond relative to its fair credit spread. Even though the B-rated bond has a relatively higher market spread than the BB-rated bond it is in fact the BB-rated bond, which is undervalued and hence a candidate for the Value factor portfolio.

The “Size factor” shares some similarities with the Value factor. Smaller companies are often forced to pay a higher spread because they are under-researched and unavailable to larger managers due to issue size constraints - rating agencies also penalize for size. Consequently, a small cap company might trade in line with its rating but be undervalued relative to its underlying financial strength – hence investors get a higher spread for a given level of leverage.

Because of these market inefficiencies, small caps will tend to recover later following a selloff. In that sense, the Size factor becomes Value later in the cycle because spreads stay wide for longer. In that part of the cycle, small cap bonds also offer an opportunity to unlock hidden value through mergers and takeovers by larger competitors with higher ratings.

Another example of companies paying higher spreads than intrinsic credit quality requires is present in Emerging Markets, where company ratings are limited by country rating ceilings. Some of these EM companies can be well established and might do very well despite sovereign stress if they have a high proportion of exports in their revenues.

At Absalon Capital, our high yield strategy has followed a factor-based investment process since 2006. Due to our long experience with Value and Size, we understand that bonds can trade “cheap” for a reason - so we emphasize bottom-up research to challenge and sanity-check potential investments. Company fundamentals are also key in our risk management philosophy - avoiding permanent loss of capital is our primary focus. We prefer companies with tangible assets and leverage below the market average to keep flexibility in the portfolio during downturns - in addition we have excluded CCCs from our investment universe to exclude the most default prone candidates. Secondly, we try to reduce drawdowns as much as possible by adjusting the overall portfolio risk to market risk premia. This is done through a model which estimates the forward 12-months default rate and compares it with market spreads. The signal from this model is combined with a sentiment signal to give a target beta for the portfolio. We use DTS (Duration Times Spread) calibrated to the historical average beta as a forward-looking measure of beta in the portfolio construction. This allows us to consider the risk contribution of an investment as opposed to looking just at portfolio weights. We also monitor several other measures of risk at our monthly risk meetings to evaluate the accuracy of DTS compared to other measures of beta such as relative VaR and historical volatility.

Strong potential for outperformance in our current portfolio

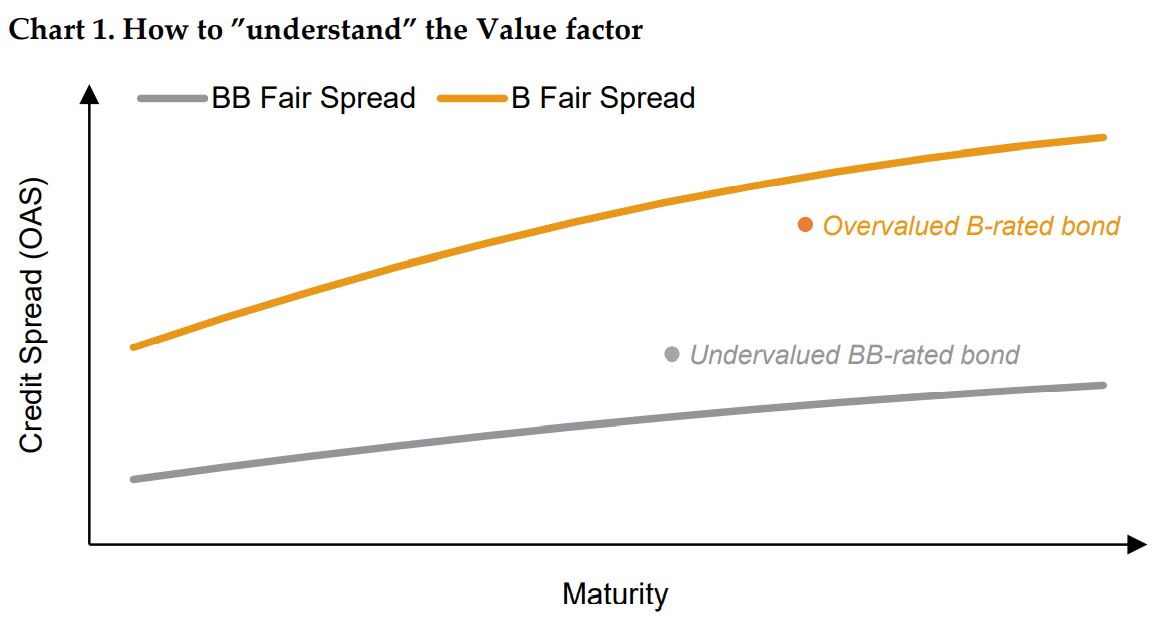

The selloff in March 2020 provided a significant stress test for our risk management and investment philosophy. Like most managers we were surprised by the magnitude of the downturn and absence of liquidity. Like prior crisis Value and Size underperformed the general market as did our strategy. Equally, our strategy was able to participate fully in the rally during the summer and last part of 2020. Despite a larger initial drawdown, we were able to limit permanent loss of capital through minimal default activity, while preserving an attractive upside. Our strong performance towards the end of last year has continued into January this year. When looking at the history we are very optimistic in terms of our relative performance in the coming 6-12 months. Chart 2 shows our performance since 2015. Looking back to the last major selloff in 2016, Value and Size performed very strongly in the first 12-18 months after markets bottomed out - so did our strategy.

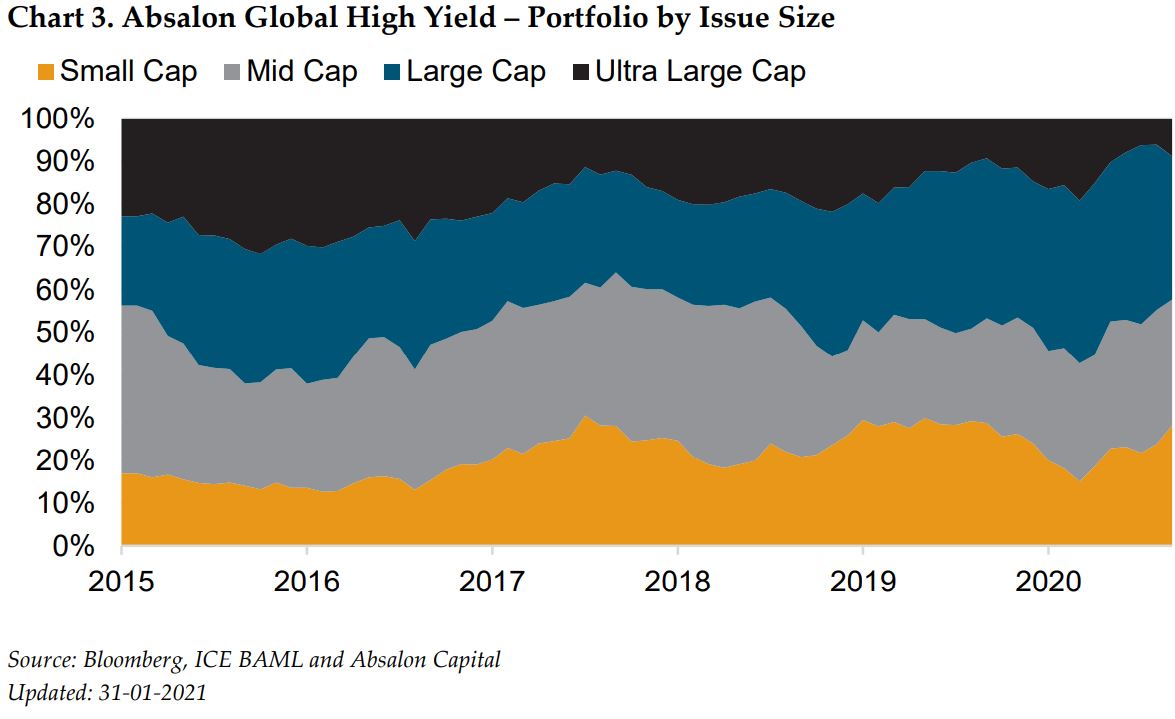

Our current portfolio is well positioned to participate in the next stage of the recovery. Because we systematically look for undervalued bonds, we have gradually been increasing our exposure to small caps in the last 3-4 month since this segment is typically the last to recover from a selloff. Our unconstrained approach also allows us to look outside the benchmark, which is even more under-researched compared to the theoretical Size factor. The result is a portfolio with an average spread of 570 bps compared to 410 bps for the index, with a better average rating and lower leverage (see table 3).

Awards Won Since Launch at Absalon in 2015

- April 2019 - Citywire Award for the best Global High Yield fund in the Nordics.

- June 2019 - 1 Goldmedal by Sauren Fonds Research AG for High Yield and Emerging Market Corporates

- November 2019 - Citywire Italy Award for best Fund Group in the Global High Yield category 2019.

- April 2020 - Refinity Lipper Award Nordics for best Global High Yield fund 3- and 5- years LC – (the Danish funds of the strategy)

- May 2020 - Citywire Germany award in the Hochzinsanleihen – Global category.

- September 2020 - 1 Goldmedal by Sauren Fonds Research AG for High Yield and Emerging Market Corporates.

- November 2020 - Citywire Spain award in the category Bonds – Global High Yield, Best Fund Group 2020.

- December 2020 - Citywire Italy award in the category Bonds – Global High Yield, Best Fund Group 2020