13. december 2022

Looking for upside?

By The Corporate Credit Team

Many fund selectors wisely focus on tracking error and maximum drawdown to assess the riskiness of a strategy relative to the benchmark. The drawback of such a narrowly focused approach to these measures, in selection, is lacking upside when markets turn.

Absalon Global High Yield offers a different approach to high yield investing compared to most other high yield managers in the market. Historically we have produced superior long-term returns by selecting undervalued credits and avoiding permanent loss of capital. We are well aware that our strategy tends to produce higher tracking error and larger short-term drawdowns – except for 2022 where alpha YTD is just below 5%. This is a result of our focus on value and the less well covered areas of the market, which tend to undershoot during a market sell-off[1].

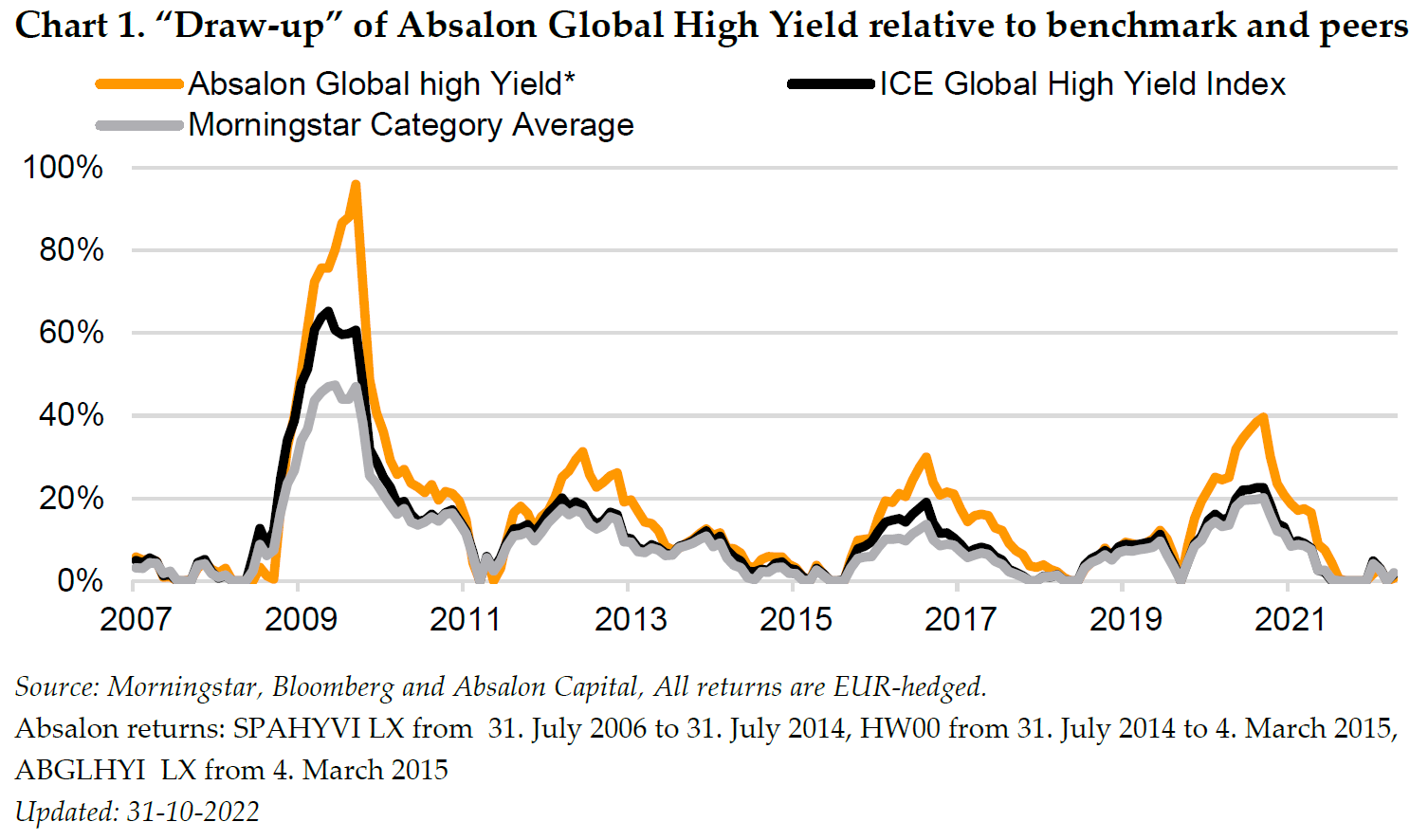

On the other hand, our strategy also has a distinct ability to outperform around turning points in the market. Because we keep default activity in the portfolio low, our undervalued credits produce stronger returns when markets recover, and bonds return to fair value. We have previously shown that the average manager tends to be low risk[2]. This approach works well for capping downside during market sell-offs, but rarely produces long term outperformance, as they miss too much of the upside when markets recover – or even when they are stable. In chart 1, we show the “draw-up” for Absalon Global High yield relative to the benchmark and average manager from the Morningstar category. We define the draw-up as total return from bottom to peak over a rolling 12-month period. Going back to the launch of our strategy in 2006, we have seen four major rallies. In all of those, the performance of Absalon Global High Yield has vastly outpaced both competitors and benchmark.

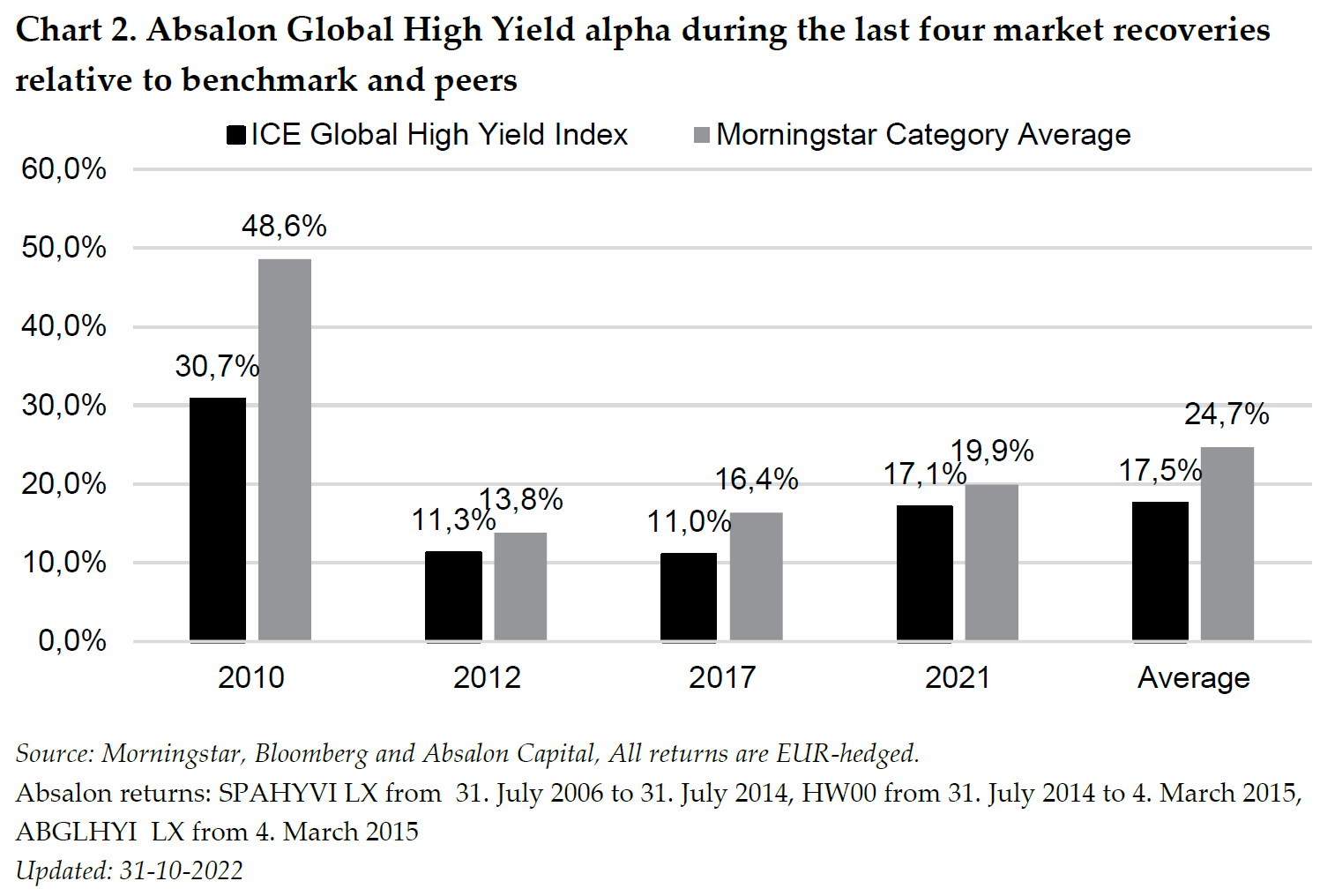

Comparing returns from low to high during the last four market recoveries, the outperformance from our strategy is 17.5% higher compared to benchmark and 24.7% higher compared to the Morningstar category on average. Looking further into the timing we also note that our fund peaks on average two months after the broad market and peers. This is consistent with the observation, that our undervalued and less well researched bonds tend to take slightly longer to recover after a sell-off, because they are not a big part of the benchmark.

The recent months have seen global high yield spreads retrace from around 650 bps at their peak to around 500 bps. Given the current large uncertainty surrounding the path of the global economy it would be brave to call the peak in spreads. Default rates will rise from here, but they remain supported by fairly solid balance sheets for high yield issuers as well as low short term refinance risk and a much stronger rating mix for the broad market compared to previous recessions. With yields still close to 9% we continue to see value for longer term investors.

Conclusion

Our strategy offers a different approach to high yield investing. The distinct focus on value and bottom-up credit selection delivers long term outperformance without compromising credit quality. Compared to the average manager Absalon Global High Yield has a distinct ability to outperform around turning points in the market. For investors with low-risk managers or cash on the sideline, we see a strong case for adding our strategy to capture the full upside when markets recover.

[1] See ”Absalon Global high Yield” and “Value – a key driver of credit returns” for more details on our process.

[2] See ”Investing with style across the global credit markets”.