6. september 2022

Investing with style across the global credit markets

By The Corporate Credit Team

Our approach to credit investing delivers long term outperformance with high probability, but it can also improve risk-return when combined with more traditional investment styles.

Value, growth, small cap and quality are styles of investing that have been a part of an equity investors’ toolbox for the past 25 years. In credit markets, the use of underlying factors or styles has been much more muted and the application among investors is still limited. An apparent reason for this is the much greater complexity. When it comes to classification of these underlying factors in credit, there is still a lack of uniformity. Encouragingly, results from recent research papers point to good return characteristics when applying factors in credit, as well as correlation benefits when combining different style portfolios (See for example Brooks, Palhares and Richardson, The Journal of Portfolio Management Third Edition 2018).

We launched our global high yield value strategy in 2005 with a distinct focus on value. In that sense it was well ahead of its time as a factor investing approach within fixed income and credit. The foundation for our approach has always been to search for undervalued bonds regardless of sector, size or country. We apply a fundamental bottom-up approach in portfolio construction, with low leverage relative to spread as a guiding principle. To achieve long term outperformance, our risk focus is to avoid permanent loss of capital. Relative risk measures such as tracking error, which is prevalent among the majority of high yield managers, is less important to us. When we invest in an undervalued bond, the value we have identified will be released at the maturity date of the bond, at the latest, provided that the company doesn’t default. Historically, this approach has produced superior long term returns for our fund relative to the market, while short term volatility has been higher. The theoretical value factor has a similar return profile. However, our approach is not quantitative. Our screening is based on a value signal, but security selection is qualitative and based on fundamental research by experienced portfolio managers. We believe this is an important difference to avoid falling knives and value-traps. Another distinguishing feature of our strategy is our exposure to small caps. Since we actively search for undervalued bonds, we often find interesting cases in the less well covered areas of the market. Issue sizes here will often be smaller, and off limits to larger managers (See our paper "Why size matters" for more on our approach to small caps). We are keenly aware that running too much capital will limit our ability to actively manage the strategy. As a result, we estimate that the maximum capacity to be below €3bn at which point the fund would be closed for new subscriptions.

Style analysis

Since our approach to credit investing is very different, the return profile of our strategy has a low correlation with more traditional strategies. Below we provide a summary style analysis for our fund versus a peer group of global high yield funds from the Morningstar global high yield category (The peer group is based on the Morningstar global high yield category. We remove short duration funds and select funds with a similar fee as Absalon Global High Yield SICAV I. In addition, we require a start data in the Morningstar database before 4. March 2015).

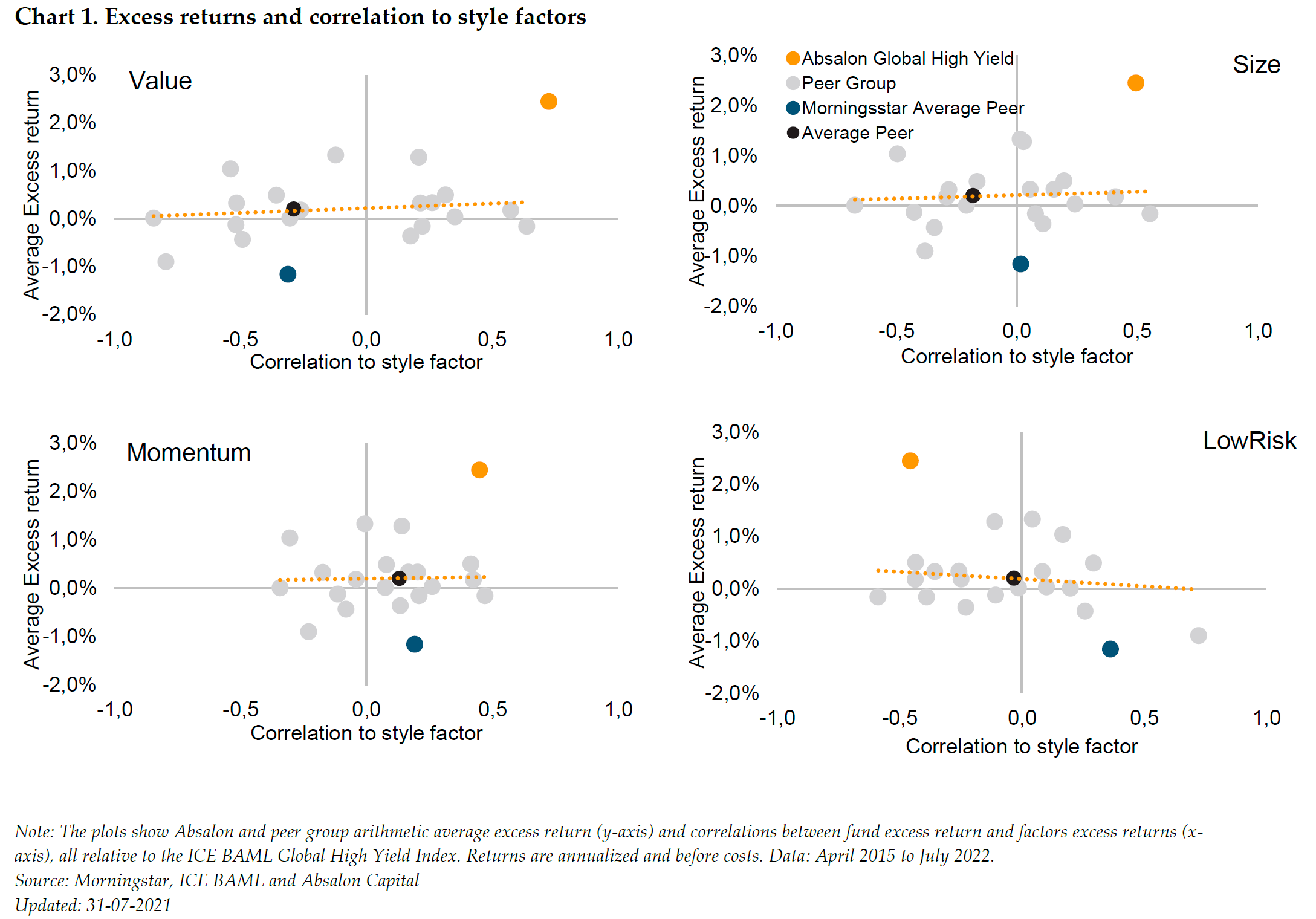

We use the theoretical style factors from our recent study to compare the performance of our fund against the peer group and average manager (See the appendix for a definition on the four style factors).

Our strategy is positively correlated with the value and size factors, as we would expect, while the average peer has a negative correlation. The high correlation to the value and size factor makes our strategy well suited to capture upside in stable to positive markets. In contrast, our strategy has a negative correlation to the low risk factor which outperforms in a downturn. The average peer is neutral to low risk and has a small positive correlation to momentum. To us this is an indication that the majority of high yield managers stay relatively close to benchmark to keep tracking error low. This approach works well for relative risk, but managers struggle to achieve long term outperformance. Looking at the average manager for the full Morningstar category sample, the correlation to the low risk factor turns positive, which creates even more drag on performance. In contrast the average alpha for our strategy is more than 2% annually.

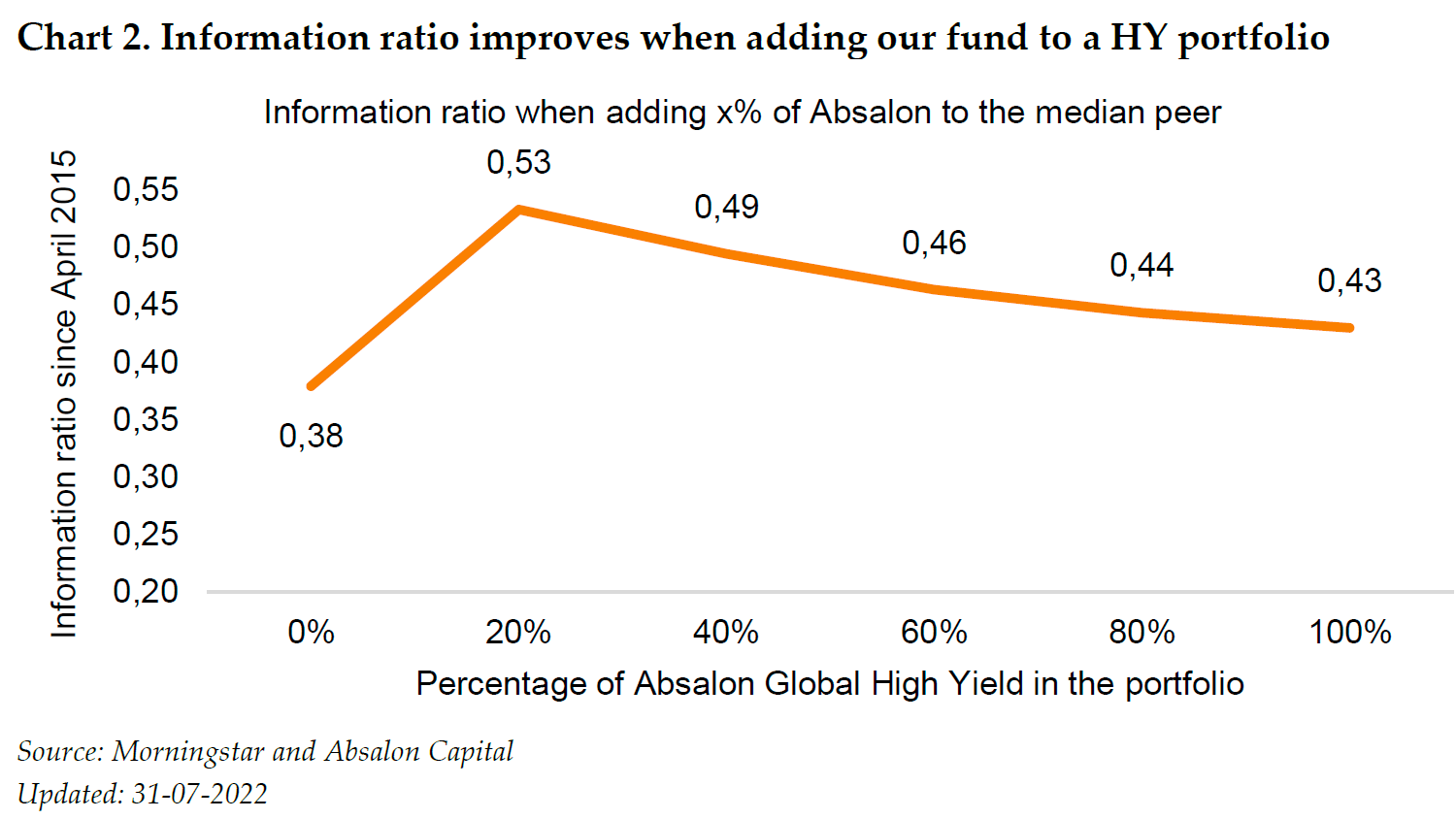

For investors with a focus on long term outperformance, we believe our strategy is ideally suited because of the unique focus on value and preservation of capital. Historically the volatility has been higher for our strategy, which can be a hurdle for some investors. However, blending our strategy with other managers can improve the information ratio of the combined investment. Ideally our strategy would fit well in a portfolio with a skilled low risk manager. Combining our investment approach with the average manager generates an improvement in the information ratio of the combined investment as shown in chart 2. Looking at the peer group members individually, the information ratio of 18 out of 19 managers improve by adding a minimum 20% allocation to our strategy to their portfolio.

Conclusion

We believe our strategy offers a very different approach to high yield investing. Our distinct focus on value and bottom-up credit selection provides an edge compared to more traditional managers. We deliver long term outperformance without compromising credit quality. We are active and our limited size provides access to areas of the market which are off limits to larger managers. Because of our exposure to value and size, the correlation to the average manager in the market is low, making our fund an ideal diversifier in a portfolio with several high yield investments.

Key benefits from our global high yield value approach:

- Superior long term returns

- Lower levels of defaults historically compared to the market

- Access to less well covered areas of the market

- Diversification benefits, when combined with other style factors

Appendix

It is important to understand how we define each factor when we analyze our portfolio relative to these basic investment factors or styles. Below we set out the classification for each of the four factors. For more details on the factor study used in the style analysis above please see our previous publication “Absalon Global High Yield - Superior long term returns through systematic investing in Value and Size”.