5. april 2021

Why size matters

By The Corporate Credit Team

Our active bottom-up approach to credit investing allows us to harvest size premiums effectively through the cycle.

Key takeaways

- An allocation to smaller issuers enhances risk/return

- Small issuers pay higher spreads for a given level of leverage / quality

- Large index aware managers and ETFs have no meaningful exposure to small cap

In a recent research piece, we reconfirmed the existence of factor premiums in the credit market, and we explained how our performance was closely linked to value and

size. In this note we focus on the size factor. Unlike large index aware managers and passive funds, we provide investors with meaningful exposure to mid and small issuers when attractively priced. Large credit funds are typically constrained by concentration risk in single bonds and therefore need to be highly diversified. While our typical portfolio contains 75-125 bonds, the average large manager in our peer group has 470 positions (Morningstar – Global High Yield EUR Hedged, Large managers defined as > €1bn.) A portfolio with such a diversified asset base is unlikely to offer meaningful exposure to small cap issuers - an important driver of excess returns in high yield credit.

The small cap premium

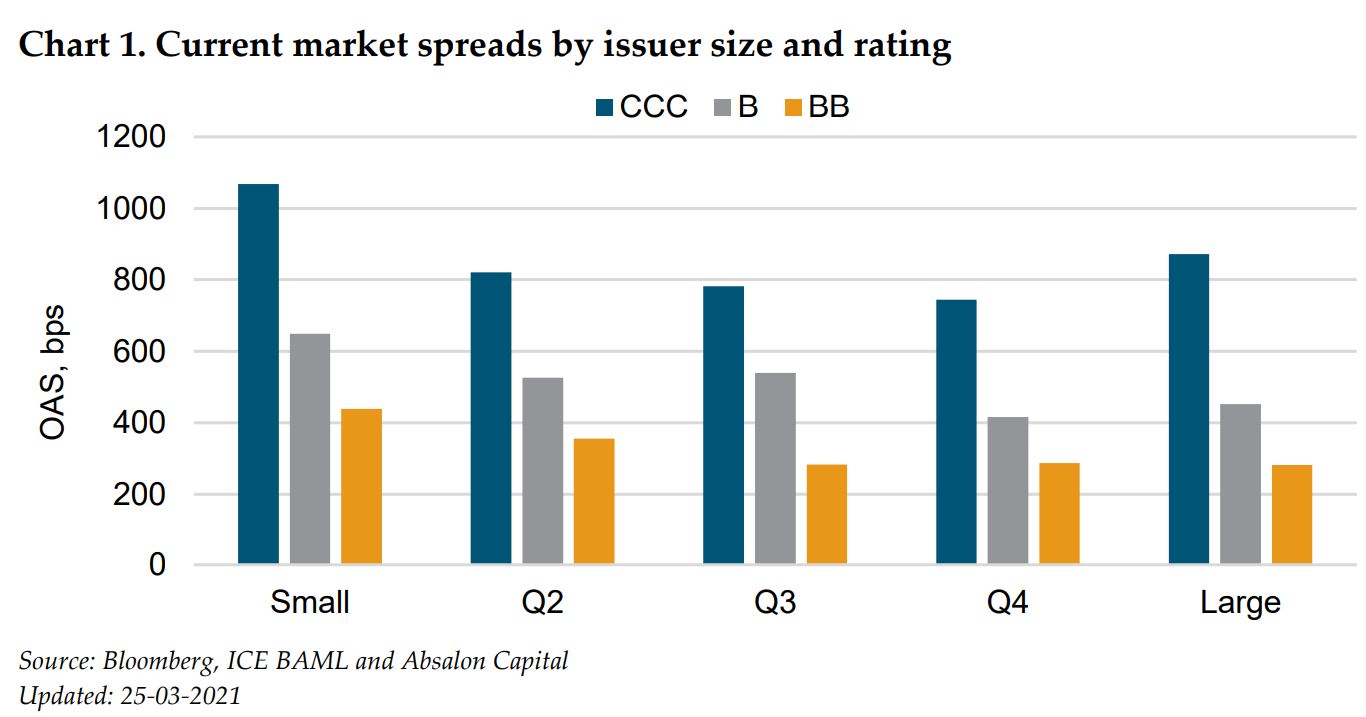

Is the small cap premium simply a reward for taking credit and liquidity risk? We do not believe it is. In the chart below we have sorted all the issuers in the global high yield index (HW00) from largest to smallest based on face value and then divided them into quintiles. There is a clear pattern that small issuers pay higher spreads compared to large. This is also robust across the ratings and maturity spectrum.

Our recent factor study shows that the size factor outperforms the market by more than 4.68% annually in our sample period from 1999 to 2021 (See our Absalon Global High Yield note published in February 2021. Return Statistics based on Excess Returns (versus duration matched Treasuries) of Long-only Factor Portfolios from January 1999 to February 2021. Results are annualized. No transaction costs.)

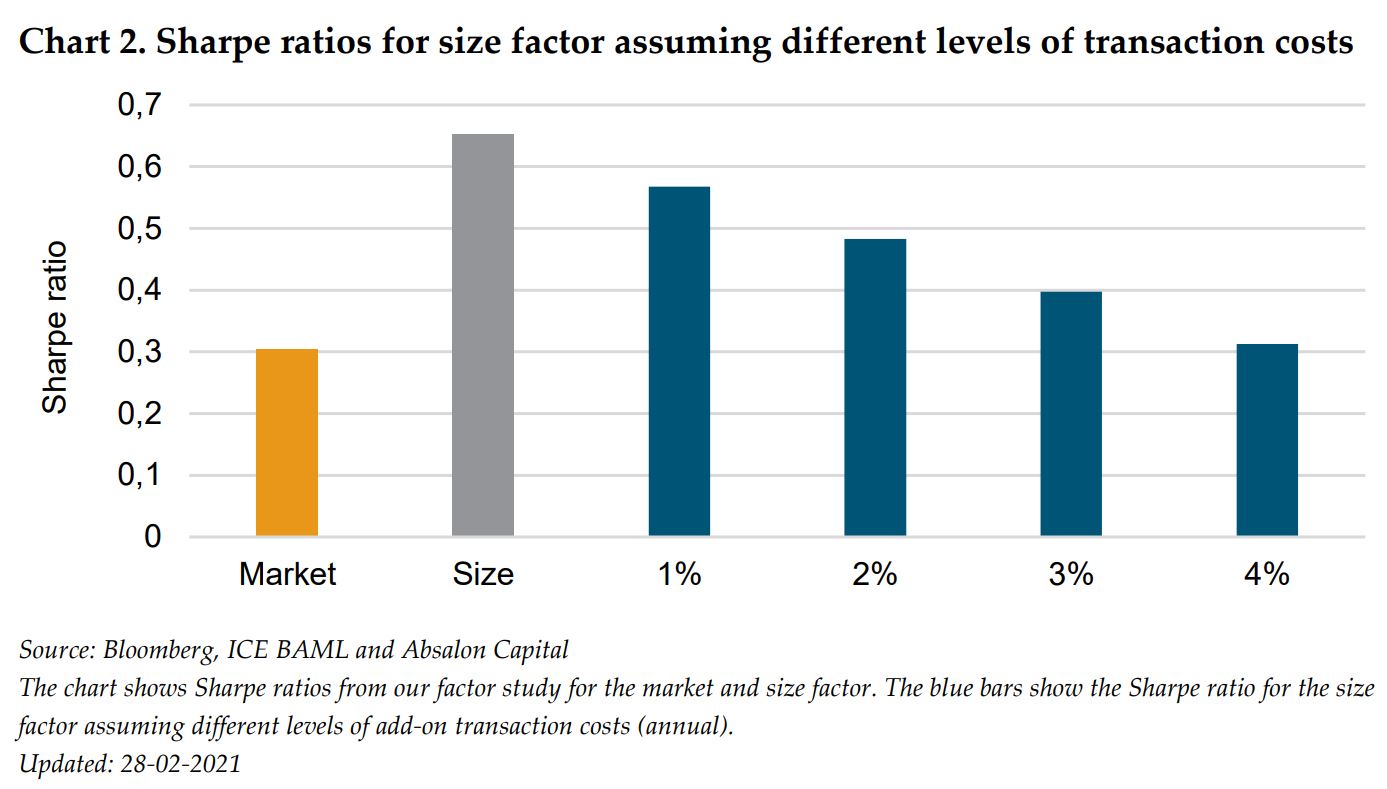

When combining those results with the observations in chart 1, we are quite confident that the higher spreads in small caps are more than just compensation for bearing greater credit risk. The risk adjusted returns are also robust to quite high transaction costs assumptions. The chart below shows that the Sharpe ratio remains attractive even when assuming very outsized transaction cost relative to the general market. This supports the assumption, that small cap spreads overcompensate for default and liquidity risk.

Why are small issuers likely to remain inefficiently priced?

The small cap premium is likely to exist for several reasons. Fundamentally, smaller companies are likely to be less diversified simply because of their size. This can also imply greater cyclicality, but not necessarily. Rating agencies will often penalize smaller companies, and give them a lower rating, because of size or lack of diversification, even if their overall credit fundamentals may be stronger - lower leverage, higher profitability etc. However, small caps can offer significant upside in a potential takeover by a larger competitor, if they have a strong business model or attractive assets.

More behavioral or technical arguments for the small cap premium also exist. Many index aware investors prefer bonds with high visibility and low transaction costs. Larger managers cannot get sufficient exposure to small cap bonds given their size and thus find it uneconomic to analyze them. The top 20% of issuers in the global high yield index account for around 60% of the market value (Source: ICE BAML and Absalon Capital). A large index orientated or ETF manager seeking to replicate, or track market returns can do so using sampling techniques to avoid owning smaller issuers. Many small cap bonds also fall below the inclusion criteria for high yield indices. This results in smaller issuers being overlooked. With fewer analysts covering and less market makers participating, the diffusion of news and pricing is also slower for smaller bond issuers, and unlike large and more liquid bonds inefficiencies cannot be quickly arbitraged away given the higher transaction costs.

Our approach to investing in the size factor

We have more than 15 years of experience managing our strategy with a distinct focus on value and size factors. Since 2006, we have demonstrated that the small cap premium can add significantly to investor returns. The risk return is not linear and varies over the credit cycle. Therefore, it is important that the exposure is scaled up and down as the credit cycle evolves. Our recent factor study also shows that the volatility in small cap bonds is generally higher than the market – we provided some possible explanations above. However, the historical returns are also much higher, resulting in a better Sharpe ratio over time.

Our unconstrained investment approach allows us to exploit the mispricing of small cap bonds much better than larger and more index aware managers. Since we can grow a small cap position up to two percent of the portfolio, it will usually be economic for us to devote analyst resources to that bond if it can produce a large excess return. However, this also limits our total capacity of our strategy. Our rule of thump is not to go above 5% of the outstanding amount in any given bond. Imposing this restriction on our historical allocation to small cap and the maximum number of positions in the portfolio puts the total capacity for our high yield strategy around 3-4 bn Euros.

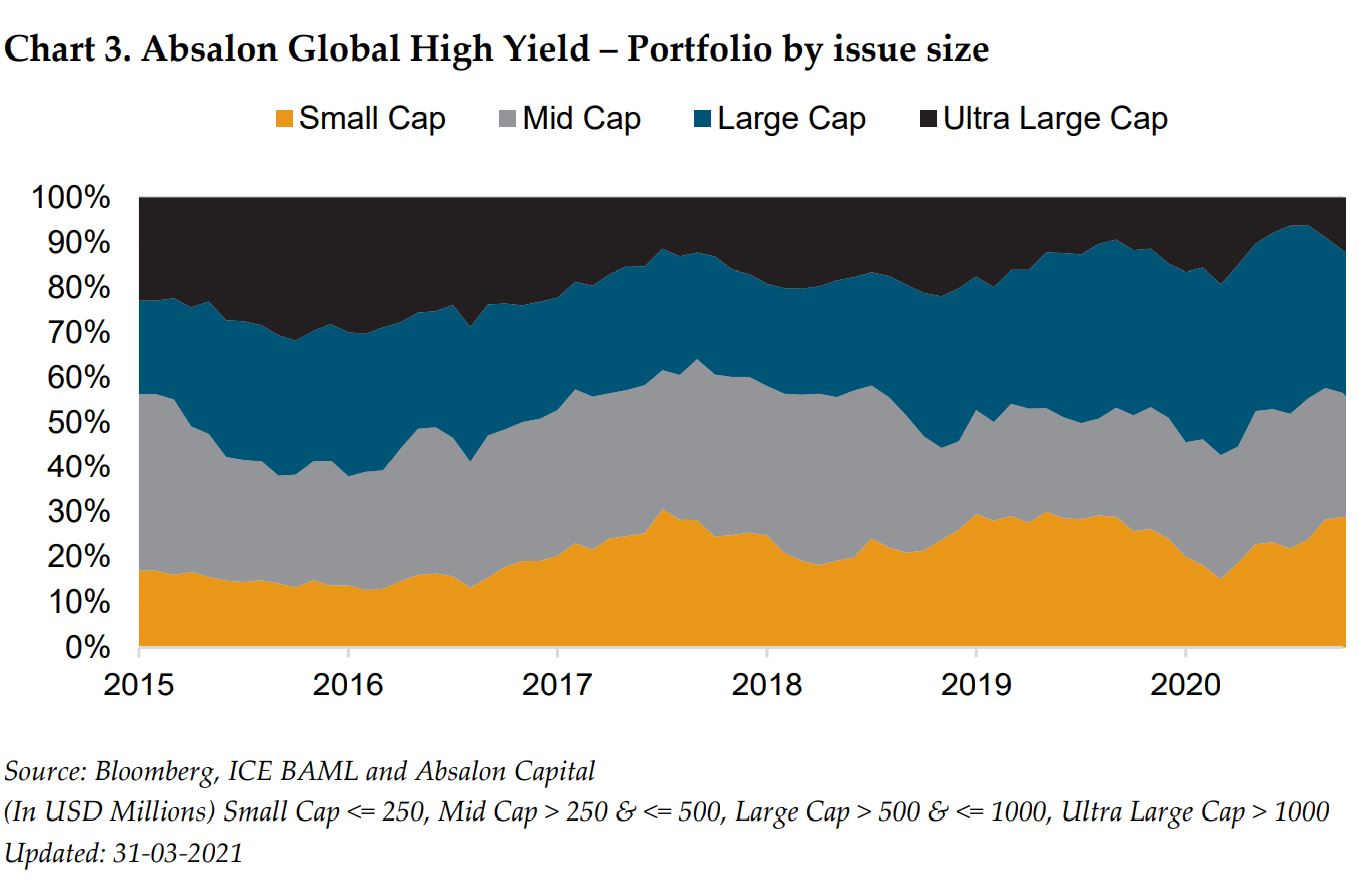

When do we invest in small cap? Our investment approach is to search for undervalued bonds. When markets sell off, many bonds get dropped indiscriminately and value opportunities are abundant. As markets recover the large and most liquid capital structures are usually first to reach fair value – small caps are slower. Therefore, our allocation to small cap bonds will tend to grow as the cycle progresses (see chart 3) as smaller bonds will appear more often in our value screen. We don’t just buy small caps because of their size – we buy them because they are undervalued.

In current market conditions with rising mergers and acquisitions we expect to see an increasing number of larger companies acquiring their smaller rivals. As we have witnessed recently in our portfolios, the change of control clause in many bond covenants mean that bonds are redeemed by the acquirer around par, thus releasing considerable value for our investors.

Two recent cases from the portfolio

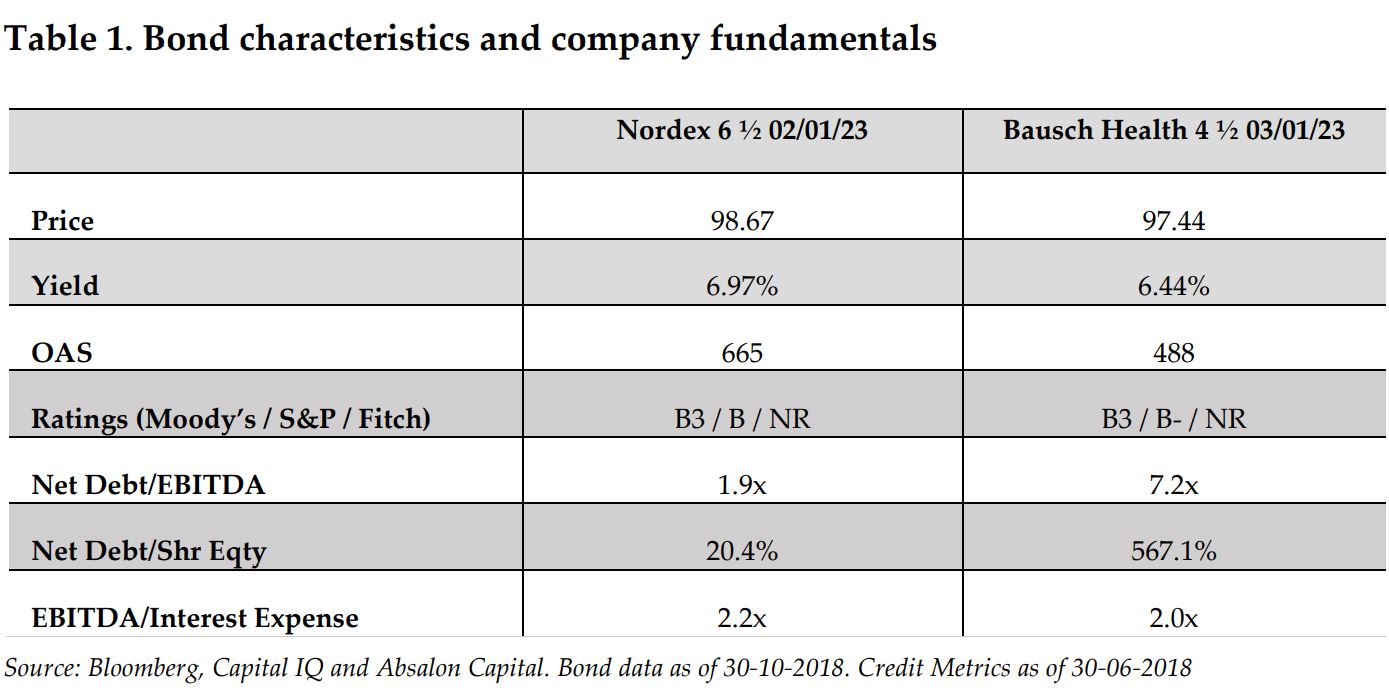

The first case is Nordex; A small German wind turbine producer and a first-time issuer when they launched the bond back in 2018. This is an example of how smaller and under-researched issuers pay a higher spread compared to larger and more well-known names. To put it into context we compare it to a bond with similar rating and maturity, but from a large index constituent - Bausch Health. In the autumn of 2018, Bausch Health accounted for almost 1% of the global high yield index, making it ideal for many ETFs and index-oriented managers wanting to keep tracking error low. Nordex was less than 0.02%.

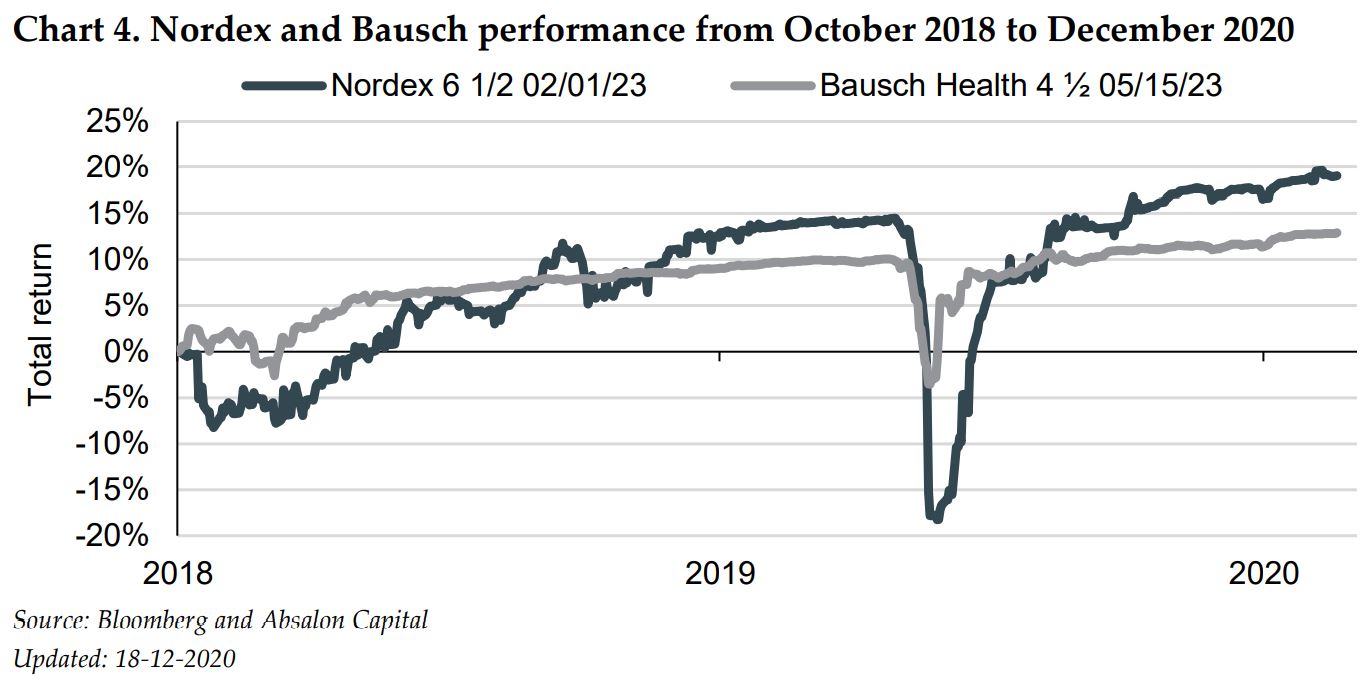

Looking at financials, Nordex has a moderate leverage of 1.9x while Bausch Health is much higher at 7.2x. Nordex is clearly the stronger credit, in our view, and it offers a spread which is 175 bps higher than the larger similar rated bond from Bausch Health. Nordex is arguably a more cyclical business, but Bausch Health also has a history of misconduct, a potential source of event risk. Rating agencies view them as roughly equally risky. We sold our last position in Nordex in December 2020 having reached its target price. Comparing performance with that of Bausch Health in the period from November 2018 to December 2020 also highlights some features of small cap investments; Volatility is higher, but investors are compensated by a higher spread ultimately leading to a higher total return. Even with a larger drawdown during the COVID19 sell-off, the Nordex bond still outperforms the bond from Bausch Health by more than 6% (see Chart 4).

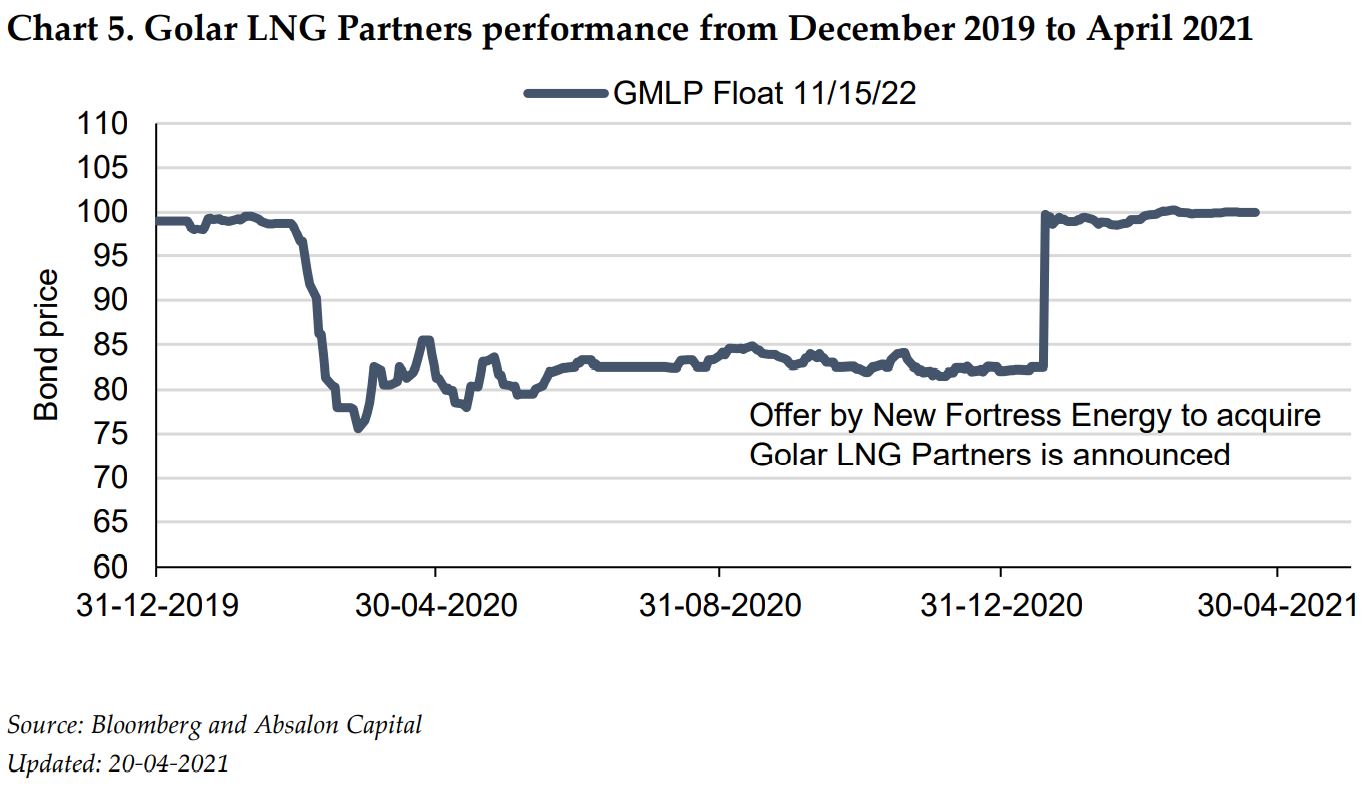

The second case is Golar LNG Partners; This is an example of how undervalued small cap bonds can release significant upside for investors in a takeover. The company was formed as a Master Limited Partnership (MLP) by parent Golar LNG to own and operate LNG transport and production vessels under long term contracts. Golar LNG Partners has a sound underlying business, but faced trouble refinancing its debt during the COVID19 turmoil in March 2020, partly due to their dividend policy. However, the company was able to leverage on its good assets to work out a solution with bondholders and extend the maturity of existing bonds. Amendments to existing terms included a 95% dividend cut to facilitate a higher coupon on the bonds as well as amortization to reduce leverage. Despite these creditor friendly amendments, bonds continued to trade subdued into the summer of 2020, when much of the broader credit market had recovered significantly. On the back of the attractive valuation, and significant deleveraging potential, we increased our position in GMLP 2022 bond during the second half of 2020 to around 1.5% by the end of 2020.

In the beginning of January 2021, New Fortress Energy announced an offer to acquire Golar LNG Partners. This immediately caused bonds to jump from around 82 to par due to the change of control clause in the bonds allowing investors to put the bonds at 101 on change in ownership of the company. The return of around 22% is a good example of how acquisitions by larger companies can produce equity like payoffs for credit investors, when buying undervalued small cap bonds at a large discount to par.

Conclusion

We believe that exposure to smaller, less efficiently priced credits, provides investors with return enhancements compared to a passive or index orientated approach. In the later stages of the credit cycle, when these smaller credits are often attractively priced, the additional returns outweigh the higher additional trading costs and lower liquidity in our view. This conclusion is supported by academic research as well as our own recent study. Our current exposure by market cap is close to historical highs indicating that our bottom-up search for undervalued bonds is uncovering many opportunities in this space. We also provide two recent examples of accretive small cap investments from our portfolio.