10. december 2021

Why value continues to deliver in credits while underperforming in equities?

By The Corporate Credit Team

Value investing in equities has underperformed for the past decade but continues to deliver in credit markets – we look at some of the reasons for this divergence and the associated opportunities and risks of a value-based approach in credits.

Key takeaways

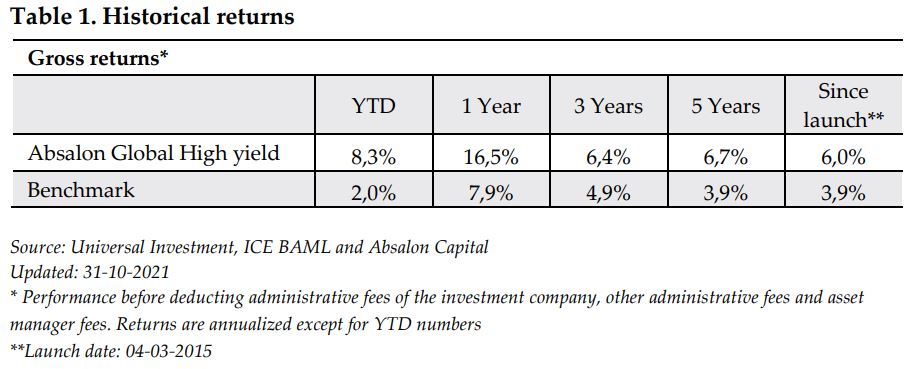

- Value in credits has outperformed in recent years while sharply underperforming in equities

- Credit markets continue to offer an attractive value premium, which is challenging to harvest for passive/quant-based funds given the market structure (complexity, data, capacity issues) and focus on low tracking error

- Our approach to value in credits offers a higher spread without compromising default risk compared to the market

What caused value to underperform in equities?

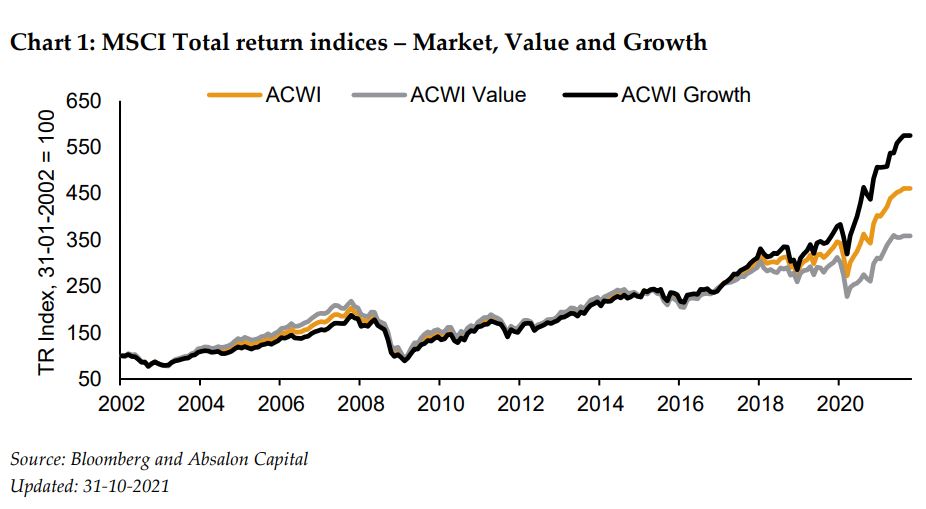

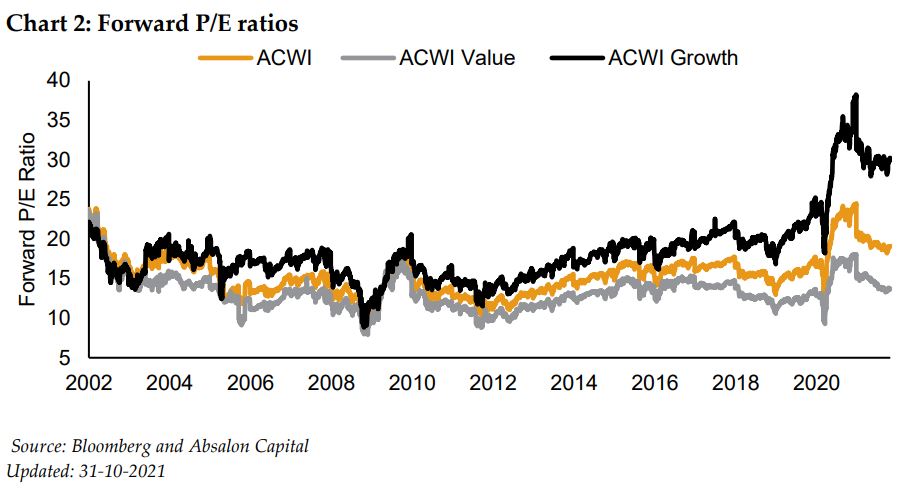

The underperformance of value versus growth in global equity markets is striking when looking at the past 5-10 years. The most obvious factor for this divergence is the dominance of large tech companies, within growth stocks, which now make up more than 15% of the total global equity index (MSCI World, 30-09-2021). The trend in P/E ratios (chart 2 below) also shows that the expansion of multiples in growth stocks has been particularly aggressive during the recent 3-5 years, implying that a lot of forward earnings growth is already priced in, leaving less room for disappointments.

The return gap between value equities and the market has therefore been significantly influenced by the boom in tech stocks, but other factors have also contributed. Heavy central bank intervention and low rates in the wake of the global financial crisis benefits growth relative to value since future cash flows are discounted to a lesser extent.

A range of accounting arguments also exists such as the use of P/B as a valuation metric and challenges with the valuation of intangibles as companies are increasingly investing into information technology, research & development and branding instead of physical assets. The amount of share buybacks, which can distort book values, has also risen in recent years and are now back at all-time highs in the US. Adding to this, more efficient equity markets have likely reduced available value premiums as they are harvested quicker by factor-based funds. The result has potentially been more value traps and weaker returns for the value index.

Finally, value tends to be more cyclical in nature. Companies within industries such as materials, energy and banking have not benefited from the very low inflationary environment of recent years - this could possibly change in the coming years if we see rising rates and a continued rise in selected commodity prices.

Why has value in credits done much better than in equities?

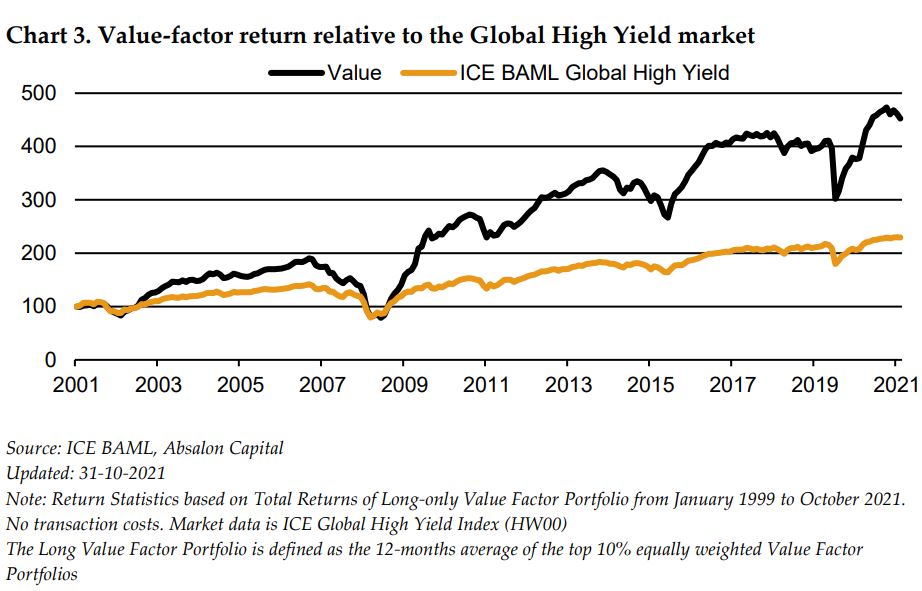

Value in equities has a long track record and a well-established investor base, with both active and passive options available. For fund selectors in credits, however, there are still very few options available to those seeking to allocate with a focus on value rather than index weighting. Consequently, there is less competition for value premiums, which is also confirmed by data showing that returns from the high yield value factor have remained above the market for the past ten years (chart 3 below).

The lack of competition stems from the inability of passive or index orientated managers to access all but the largest index constituents. Credit ETFs typically herd towards the largest index constituents to minimize tracking error compared to the standard market cap weighted indices.

While there is an increasing volume of literature making the case for a quant or rules-based approach to value in credit, we do not currently see signs that this type of fund has been able to overcome the obstacles presented by market complexity, access to data and capacity constraints. Compared to equities where a company typically issues one type of stock, it can issue multiple bonds with different subordination, duration, and covenant terms. Equity investors also have relatively easy access to company data because investments are listed on a stock exchange, whereas many high yield bonds are issued by unlisted businesses with private or less accessible information.

The result is less efficient pricing and therefore a potentially larger opportunity set for active, unconstrained managers who can access opportunities across size, rating, and sectors.

Although the number of private data providers have grown in recent years, complexity remains a barrier to entry for quant funds making it more complicated for them to arbitrage value premiums away. For larger “active” managers with in-house analysis capabilities, it will often be uneconomical to devote analyst resources to medium and small cap bonds since they cannot get sufficient exposure in their funds to justify the work relative to larger capital structures.

Read more about the small cap effect.

Turning away from structural considerations and looking into implementation, the value approach in credit markets also has some noticeable and important differences compared to equity.

The most obvious difference is that as a credit investor benefits from a known maturity date. Bond cashflows are contractual and have defined maturities, so they are much more predictable and subject to less assumptions than for equities. Thus, investing in an undervalued bond will release the value at or before the maturity date assuming the company does not default. For an equity investor the full value is only released once the market recognizes that the company is undervalued.

Another distinguishing feature between value in credit and value in equities is the relative approach in credits.

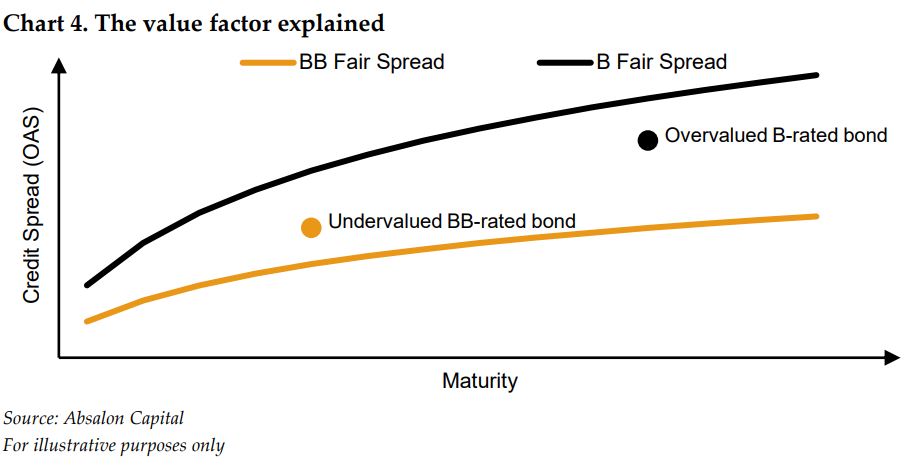

As we have shown in previous notes the value factor in credits is constructed by comparing spreads of similar rated bonds. This implies that a higher quality BB bond might well have a better value score compared to a lower rated B or CCC bond with a higher absolute spread (chart 4 below). For value equities, the value score is typically done on P/B or forward P/E. However, this is more of an absolute measure since the value metrics are not necessarily compared with companies of similar risk – you might well end with a riskier or lower quality portfolio compared to the market. For credits this would compare to screening for the highest absolute spreads resulting in a riskier portfolio with higher volatility.

The relative approach in value credits reduces portfolio risk to some extend and helps avoid large concentrations of potential value traps.

Our approach to value in credits

The value philosophy at Absalon Capital has been developed and refined during the past 15 years. We invest with conviction, and the ambition to exploit mispricing across markets irrespective of rating and size without being constrained by an index. Compared to the pure quantitative approach in chart 3 above, our strategy adds a bottom-up layer to the security selection, which also considers the fundamental position of the company.

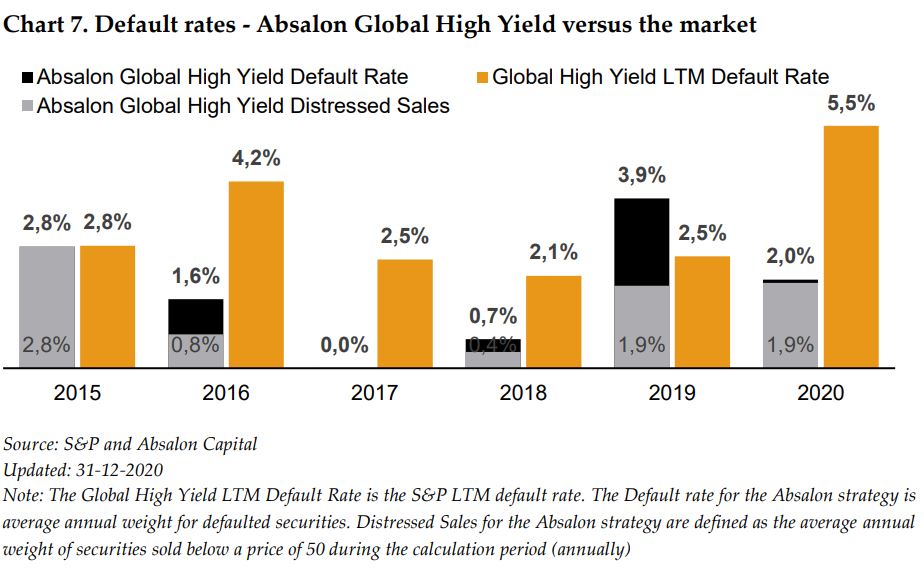

This allows us to run a more concentrated portfolio with lower leverage compared to the benchmark, while removing some of the weakest issuers with the highest likelihood of default (We also exclude investments in bonds rated below B- to further limit the default risk in the portfolio. Downgraded securities can remain in the portfolio).

A well-known drawback of the value approach is the somewhat higher volatility. But since we limit permanent loss of capital the historical returns have consistently been above the market and peers.

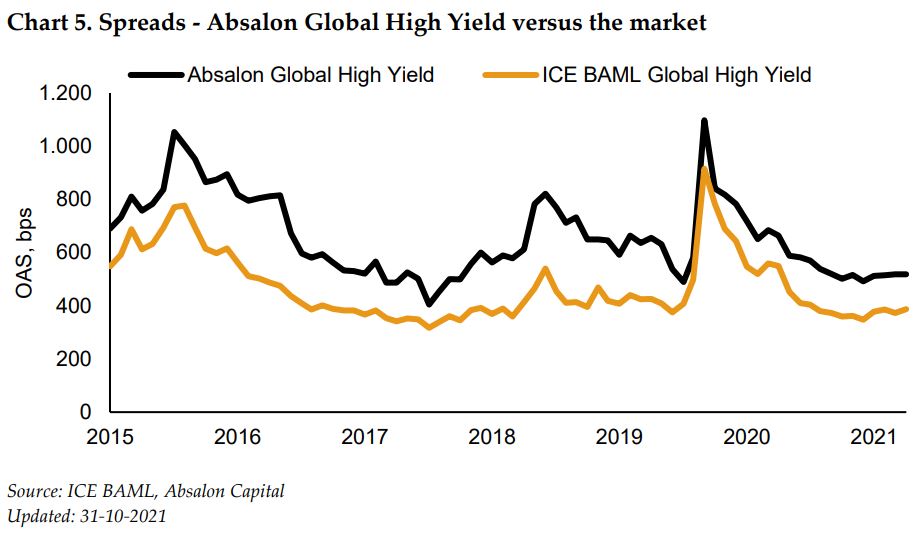

Looking a bit deeper into the historical performance of our strategy, we plot the spread of our global high yield fund relative to the overall market in chart 5 below. It clearly shows a sustained spread pick-up over time, which is no surprise, since our bottom-up value approach looks for mispriced bonds trading above their fair value spread as outlined in chart 4 above.

As part of our detailed bottom-up analysis we look for bonds which pay a higher spread and are less leveraged on average compared to the index. The purpose of the latter is to ensure that companies have sufficient financial flexibility to withstand an economic setback and avoid default. For the same reason we also exclude investments in the lowest quality credits (CCC+ and below).

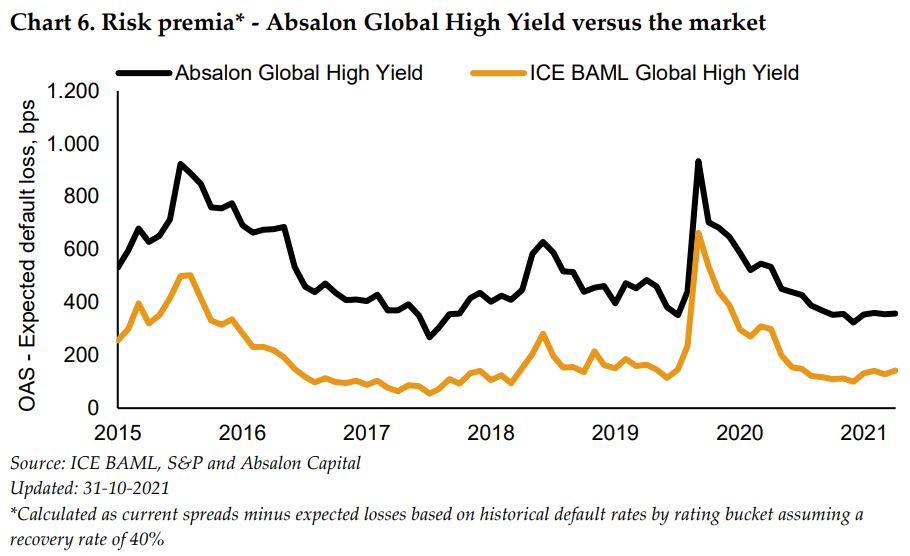

From a risk premia perspective, our portfolio benefits from a higher spread and a better rating mix translating into a lower expected default rate over time. Using historical default probabilities, we calculate the rating implied default probabilities over time and subtract those from the spread of our strategy and the benchmark.

The lower implied default probability of our portfolio means that the expected risk premia in chart 6 exceeds the pure spread difference in chart 5. The long-term outperformance of around 2% p.a. for our global high yield strategy also suggest that we have been able to collect these premiums quite consistently over time. This is only possible if actual defaults are kept low, which is confirmed below in chart 7 to provide further transparency we also show distressed sales along with the actual defaults - this does not alter the picture.

Thus, our approach of limiting permanent loss of capital allows us to collect the risk premia from our undervalued bonds over time and consistently outperform the market.

The benefits of our approach include

- Higher spread relative to overall market

- Lower default rates

- Accessing parts of the markets off limit to large funds and ETFs

- Improved portfolio diversification benefits when combined with other funds

- High probability of outperformance

Conclusion

The reasons for value equities failure to deliver attractive relative returns are abundant and complex. They include more efficient equity markets competing for the same premiums and numerous valuation issues. For credits on the other hand the market structure remains more fragmented leaving more opportunity for value-based investors.

The more complex structure and lack of easy access to data continues to be a barrier for quant-based funds, while larger managers focus on the big issuers due to capacity constraints.

Our approach adds a fundamental layer on top of a generic value approach, which allow us to run a more concentrated portfolio with a high spread and lower expected default risk relative to the market.

Historically we have been able to keep permanent losses low, resulting in substantial outperformance relative to the benchmark and peers. We remain confident that an investment philosophy focused on the opportunity set and not an issuer’s size in an index, will allow us to outperform from investing in parts of the market which remain out of reach to larger and more diversified managers.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.