26. januar 2022

Value investing also works in hard currency EM corporate credit markets

By The Corporate Credit Team

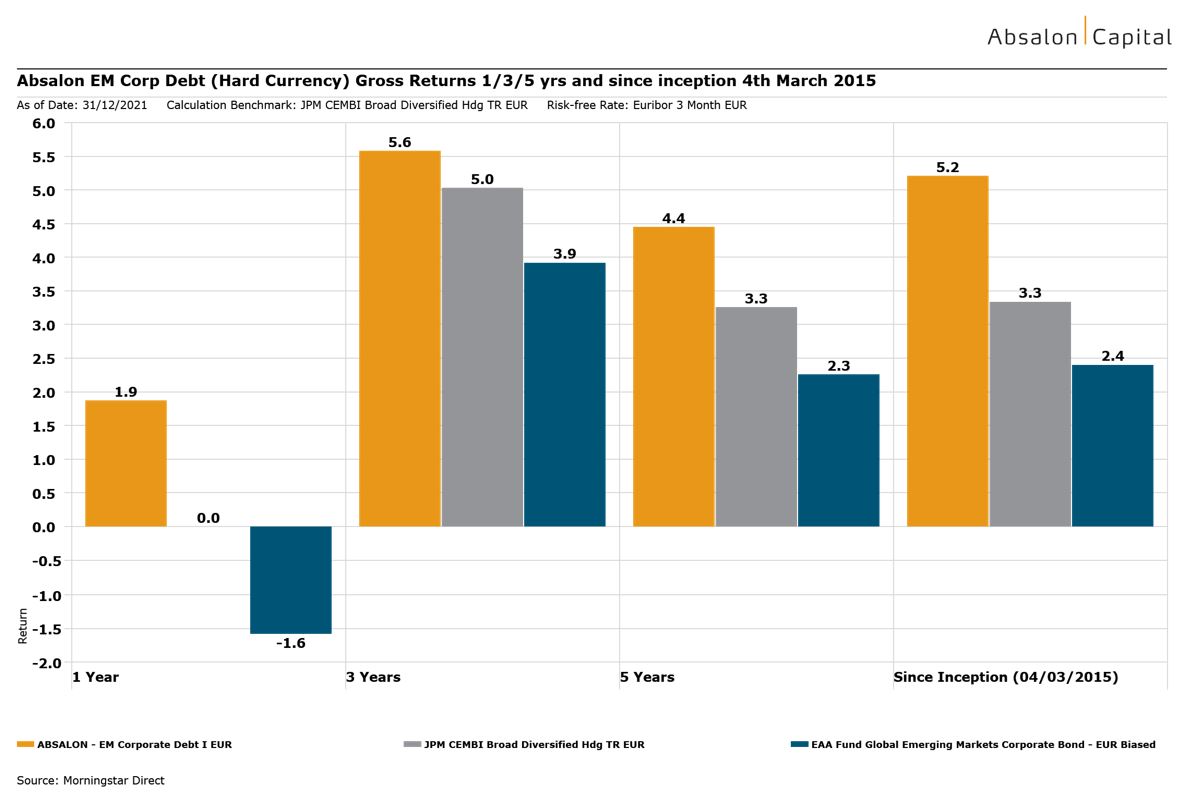

In our post last week, we showed how a value approach in Global High Yield continued to deliver, this week we show how our value approach worked in our EM Corporate Debt strategy during 2021.

A few things to note about the performance

- The value approach works in EM Corp Debt, just as it does in Global HY

- Continued outperformance in 2021 despite macro headwinds (China, Ukraine, Turkey, Chile)

- Focus on attractive opportunities, not index weight

- Invest with conviction in strong companies in out of favour countries

- We do not invest relative to an index - following an index rarely produces outperformance

- Same team and strategy for past 12 years

- Selectively invest in undervalued, low leveraged credits = higher yield/lower defaults

- In 2022 investors should remain active, unconstrained and value focused

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.