22. september 2021

Does the US High Yield market represent 53% of the best ideas for global high yield investors?

By The Corporate Credit Team

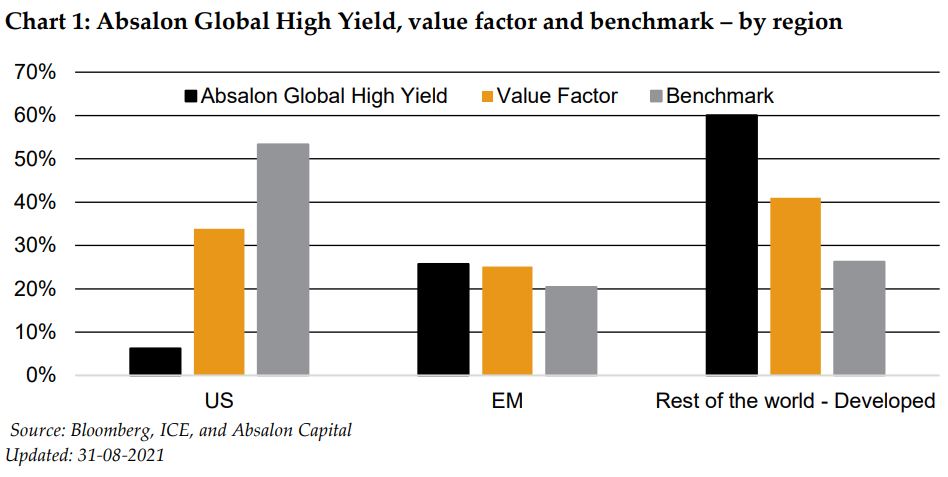

While US companies currently represent more than half of the global high yield index, our bottom-up selection process suggest that value is better found in other areas of the market.

Summary

- The US high yield market has become increasingly less attractive as spreads compressed back to pre-pandemic levels. Pockets of value are still evident, mainly in US energy names, but alternatives in Europe and Emerging Markets offer better value in our opinion.

- Our value approach and ability to invest outside the index largely explains the current underweight towards the US.

- Aggressive debt financed M&A and share buy backs, which are particularly prevalent in the US, rarely benefit debt investors.

The US high yield market remains the largest single allocation in the global high yield index and consequently in many high yield managers portfolios.

Since the launch of our global high yield strategy in 2006, we have managed it without the constraints of an index. Being unconstrained and focused on the size of the opportunity set, and not the weight of an issuer in the index enables us to capture more of the unique opportunities to buy undervalued credits in the global high yield market.

A more traditional approach places greater emphasis on tracking error relative to a benchmark and thus ensures that the manager does not stray too far from index positioning, leading to a structural bias to the US among the majority of high yield managers.

Over recent months we have increased our US underweight further, taking profits in fallen angels, many of which we bought during the height of the pandemic sell-off, across the auto and energy sector. Some examples are Ford, GM and Occidental Petroleum. Our US exposure is currently historically low at 6% compared to 53% for the index, reflecting the presence of better value opportunities outside the US.

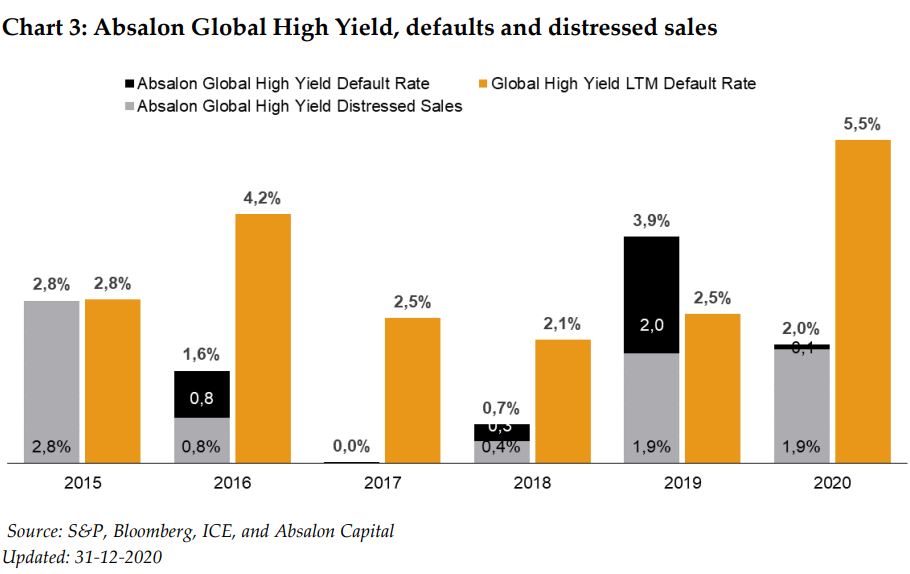

Now, should investors see this substantial underweight as a risk? And what are the causes of this significant divergence from index? Risk should never be defined using a single metric. Volatility or tracking-error are mark to market measures of risk. They are not measures of fundamental risk; the risk that the bond you own defaults.

As part of our idea generation, we seek to identify pockets of value for further fundamental research. Using our in-house factor analysis as a guide, we identify bonds that are trading undervalued relative to their credit quality. The results of our latest value factor screen (chart 1) reveals that US names still account for more than 30% of the top candidates – a sizable share but still far below the index weight of 53%.

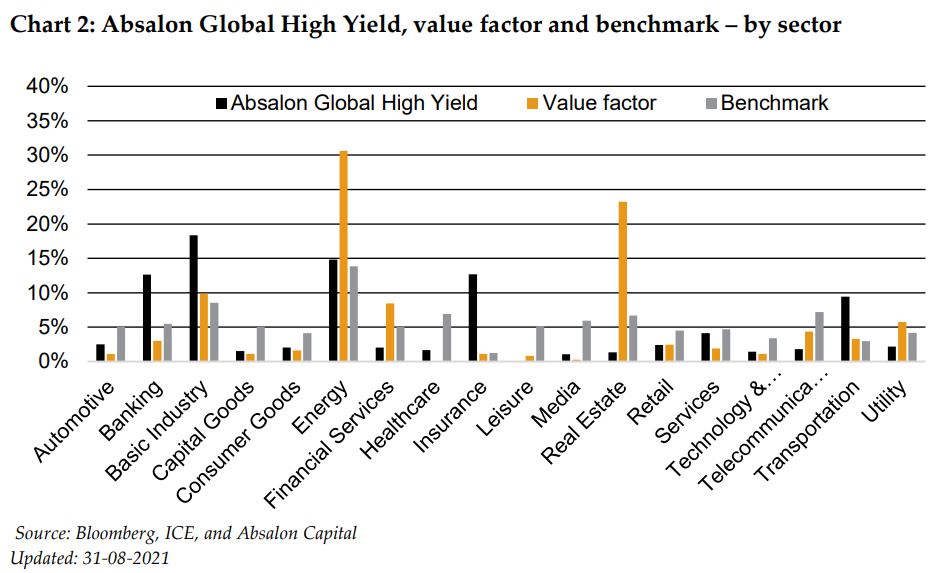

However, looking at the sector composition of the US candidates, almost half of them are related to the energy sector, with many being fallen angels.

Ratings are relatively high, but spreads have narrowed rapidly aided by the stimulus package launched by the Federal Reserve and rising oil prices. On the back of our fundamental view, and ability to look outside the index, we find better value in North Sea energy companies, where we can get more spread per turn of leverage.

Stripping out the energy exposure from the value factor screen leaves just 18% of the candidates in the US. This is much closer to our current portfolio and is a significant part of the explanation for our underweight in the US relative to the benchmark.

Looking further into the sector composition of our portfolio we currently find many cases in sectors geared towards the reflationary theme, including Energy, Basic Industries, Transportation and Financials in particular. Many of these cases are off benchmark with most of our small cap investments in Basic industries and Transportation.

Our investments in Banks and Insurance are also mainly found outside the index with investments mainly in European contingent convertibles. We have had this large overweight for some time on the back of high spreads and creditor friendly behavior supported by tighter regulation. European banks and Insurance are very good examples of sectors where we have been able to invest outside the index in attractively priced issuers without the need to “go down in quality”.

We also maintain a large underweight in Healthcare, a choice which is largely supported by the value factor screening which doesn’t have any weight in this sector – a large US sector and overvalued in our opinion.

Another notable difference in our portfolio compared to the index, but even more so compared to the value factor screen is Real Estate. Chinese real estate is clearly the driver here, but it does not sit well with us fundamentally. Historically, the business model has not been fully transparent to us and relies heavily on short term financing. Potential government interventions are also risks which have not been reflected in spreads, in our view.

While valuations have recently improved as the government has tightened its grip on the sector with the introduction of the “three red lines”, contagion fears from the current distress of Evergrande (the second largest Chinese real estate developer), still overshadows the market with very elevated spreads.

When looking at our current US underweight, we find that it is largely explained by the significant difference in our sector weightings relative to the index and our ability to invest outside the benchmark. But there are also other observations which support our positioning.

We have witnessed the recent return of debt financed share buy-backs, especially in the US. The pandemic put this on hold last year, as companies were hoarding cash to survive, in the second quarter of 2020 US companies bought back just $90bn of stock.

In the second quarter of this year the number rose to $200bn, with Goldman Sachs forecasting an additional $460bn for the rest of 2021. Share buy backs serve equity investors well by potentially boosting return on assets. For debt investors share buy backs increase balance sheet leverage thus the overall default risk.

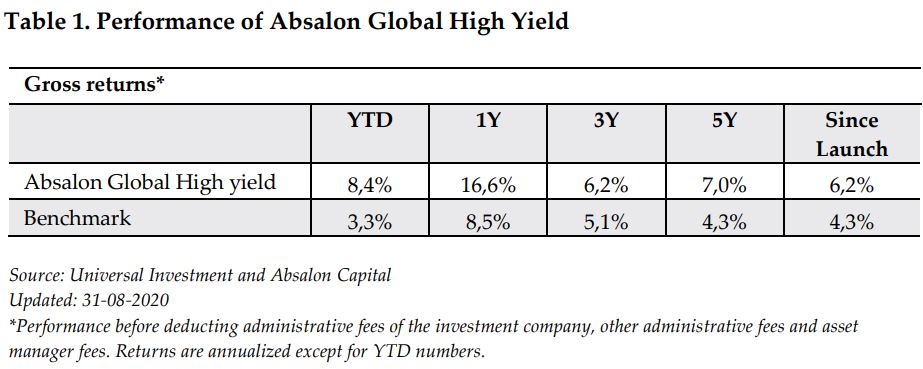

Our bottom-up selection process focusses on issuers with high spreads compared to leverage to generate outperformance on a consistent basis. A key driver behind the outperformance of Absalon Global High Yield is the ability to keep defaults in line or below to the overall market. That allows us to collect the excess spreads over time.

Conclusion

We believe that the current market conditions call for a more opportunistic, bottom-up approach to credit selection. The focus should be on the size of the opportunity rather than index weighting. At the present time we do not believe that 53% of the best ideas are in the US, as a global index might dictate. As a value investor in the high yield market, we avoid following the herd and currently find fewer attractive opportunities in the US market, where aggressive corporate behavior, and the increasing use of share buy backs and leveraged M&A deals, weakens the position of debt investors. In our view our track record of collecting excess spreads, while keeping defaults low, is a strong foundation for future outperformance.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.