4. april 2022

Value in global high yield?

By Klaus Blaabjerg and Peter Dabros

Do current yields represent a good entry point for high yield investors?

Key takeaways

- The positive momentum in global high yield of recent weeks has erased most of the post war spread widening

- All-in yields have still improved significantly since the beginning of the year providing a stronger cushion for investors

- Long-term investors should take comfort that only the worst 6 months of the global financial crisis saw negative 5 year returns for the asset class going back to 1998

- Our approach of selective buying of undervalued credits should continue to perform well relative to more index oriented managers

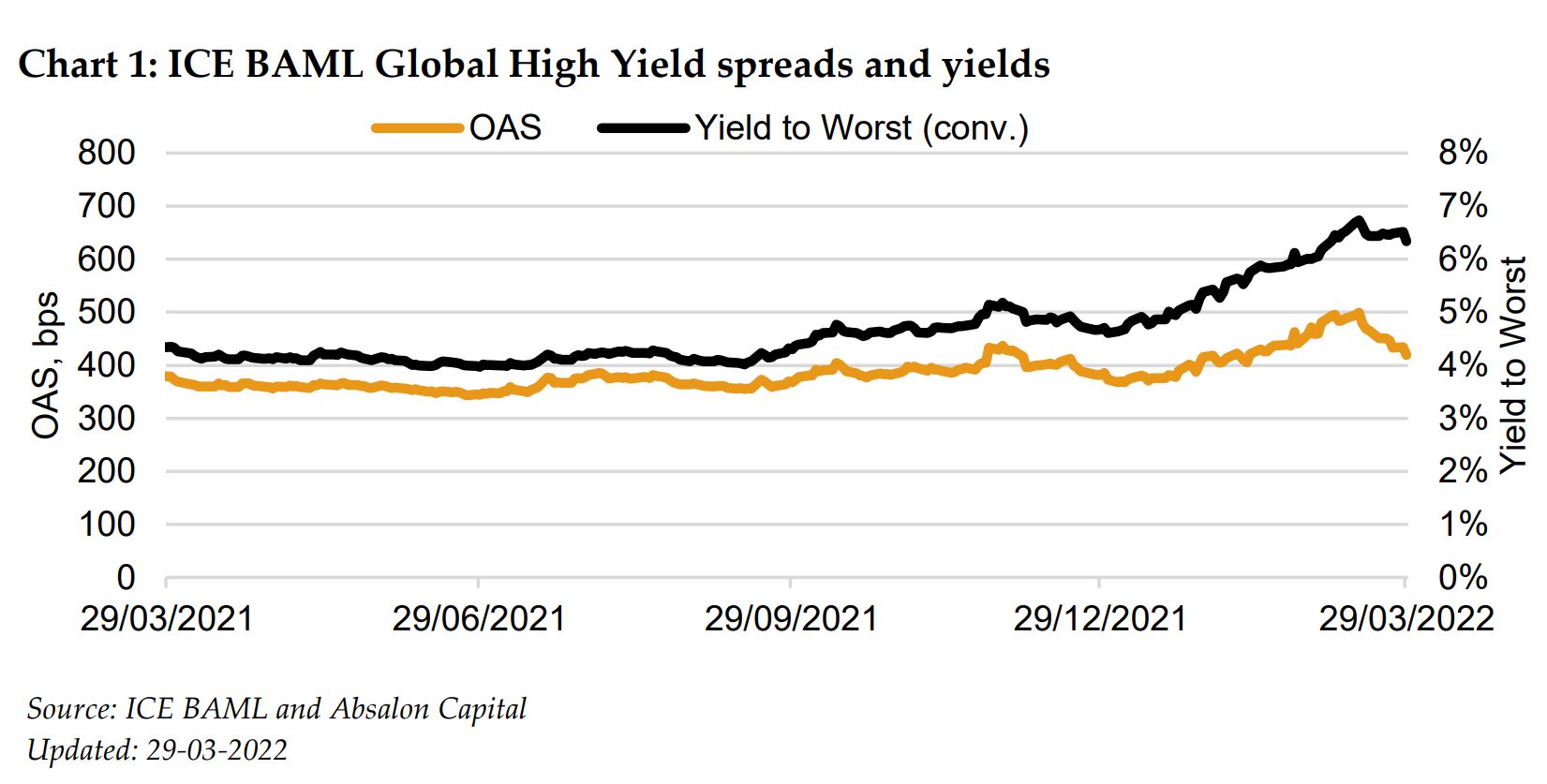

The Russian invasion of Ukraine coupled with rising rates in the US and elsewhere, have unsettled investors. Spreads reached post COVID19 highs in mid-March, but recent weeks have seen positive momentum building in global high yield, especially driven by the US market given the country’s limited trade with Russia. Europe with its heavy reliance on Russian oil and gas has underperformed as investors fear the economic consequences of rapidly increasing energy costs and further pressure on supply chains. European high yield spreads have widened by around 70bps since the start of the year, while US spreads are just 25 wider currently. At the same time rates have continued to climb, resulting in a rise of the all-in yield of 1.6% for the ICE BAML Global High Yield index, since the beginning of the year.

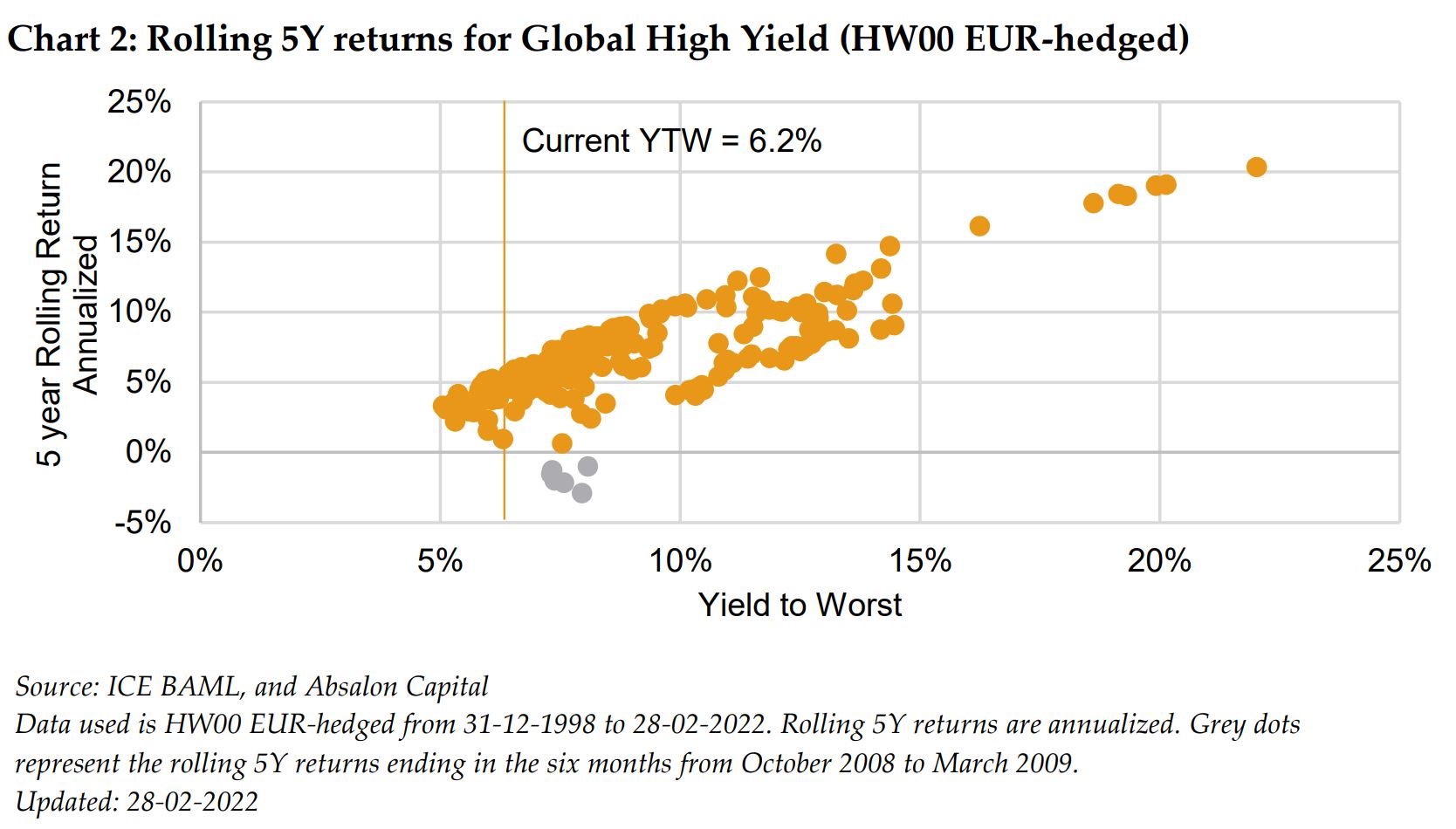

Do current yield levels offer an attractive entry point? Looking forward, portfolio yields are a reasonably good indicator of longer-term returns. At current levels, the overall market (ICE BAML Global HY index) offers a yield to worst of 6.2% which is still at the lower end on a historical basis. However, as the chart below demonstrates, long term investors should take comfort that rolling 5 years are likely to be positive with a very high probability. In fact, there are only six rolling 5Y returns during the period from December 1998 to February 2022, which have seen negative returns. Those where the six worst months during the global financial crisis from October 2008 to March 2009 (grey dots in chart 2 below).

Although defaults will likely end higher than the widely forecasted 1-2% at the beginning of the year, the increased yields do provide a better buffer for total returns even at more normalized levels of default. History also shows that global high yield as an asset class does quite well during hiking cycles. Risks to this scenario are lower growth and more persistent levels of inflation, possibly enhanced if the conflict in Ukraine drags out or even escalates further. Europe is more vulnerable. To us this underlines the need to be selective and avoid companies which are most exposed to higher cost and margin pressure.

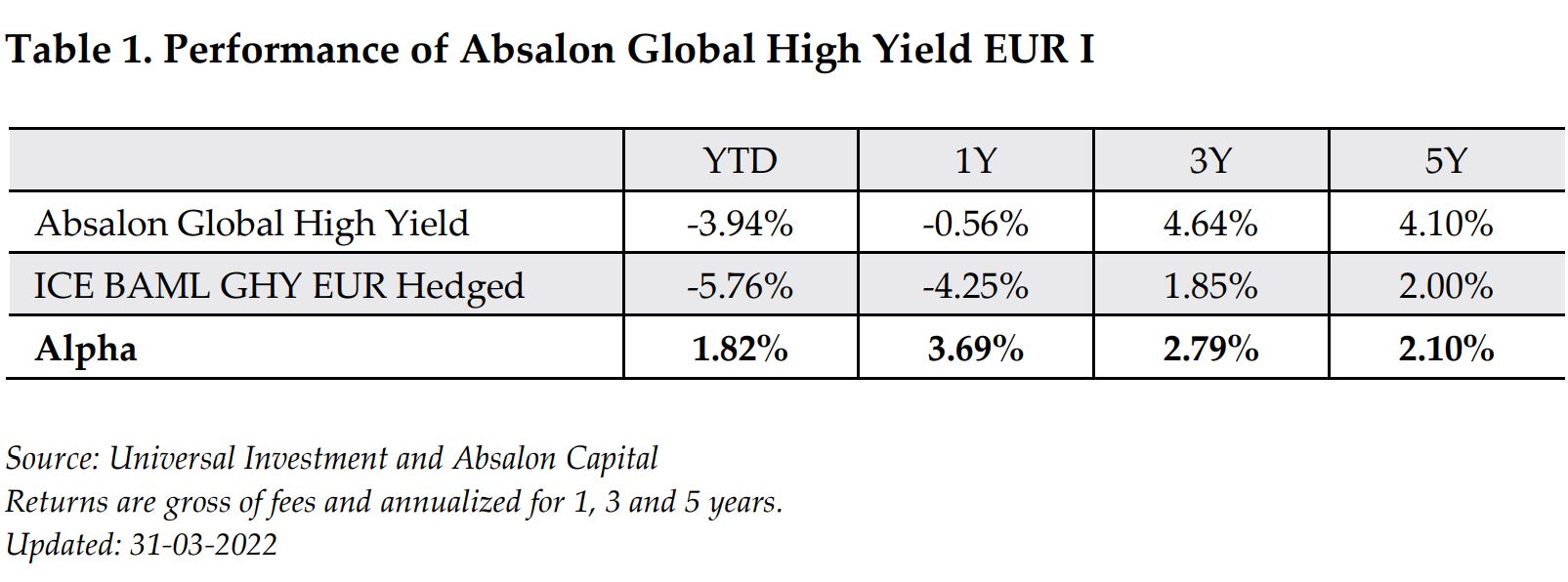

Our ability to focus on the most attractively valued credits while avoiding overvalued/highly leveraged issuers regardless of index composition seems well suited for the current environment. Given the backdrop of rising rates and a potential conflict in Ukraine going into the year, our conviction in undervalued credits from sectors with natural hedges against inflation such as energy, raw materials and financials was higher. In addition, we did not have any exposure to Russia and very limited exposure in Ukraine, which supported a strong outperformance for our global high yield strategy during the first quarter of 2022.

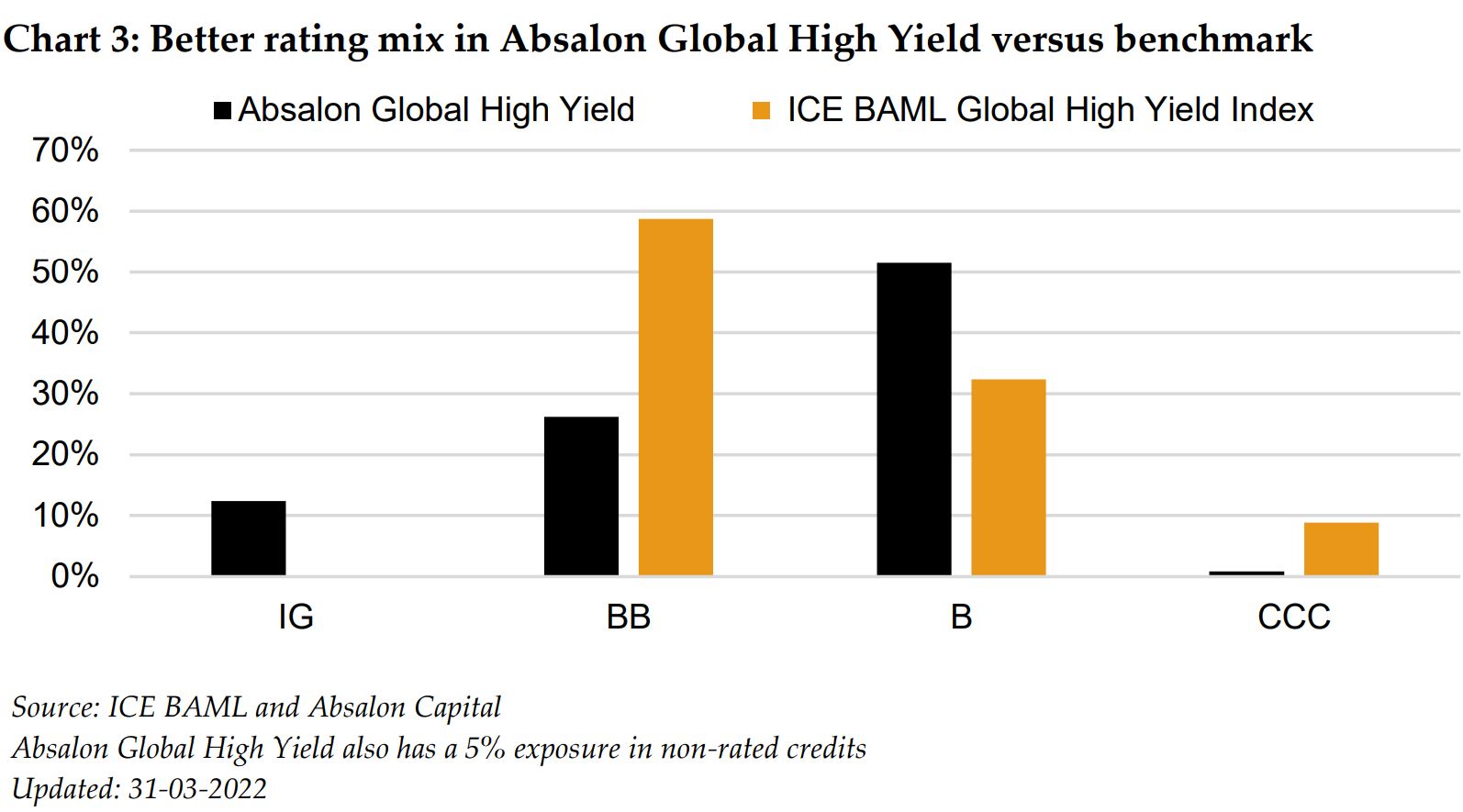

We believe that a selective approach in global high yield will continue to deliver superior returns relative to a more index/tracking error constrained approach in the

current environment. Our value approach consistently delivers a portfolio yield above market levels as we focus on bonds with wider spreads relative to their default risk. For context, the current yield of Absalon Global High Yield is 7.7% relative to 6.2% for the ICE BAML Global High Yield index. The average credit rating is also one notch above at BB relative to BB- for the index. From a default risk perspective, the difference is even more pronounced, since we don’t invest in CCCs which are by far the most exposed to bankruptcies.

Conclusion

Markets have largely digested the new reality in Europe, with global high yield spreads back to pre-crisis levels. Rates however have continued to rise and now provide a stronger cushion for total returns. Our selective approach of buying undervalued credits has performed well during the recent sell-off as our conviction has been greater in companies with natural inflation hedges. We believe that a selective approach remains key to outperformance going forward.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.