21. marts 2022

It is time to get selective in Global High Yield

By The Corporate Credit Team

Russia’s invasion of Ukraine during the past weeks has had a devastating impact on the lives of millions of people. The aggression from Russia has also challenged financial markets ranging from commodities to more traditional risk assets such as equity and credit. Simultaneously, we have seen interest rates creeping up as markets digest what looks to be the beginning of a new hiking cycle as central banks focus on the sharp rise in inflation.

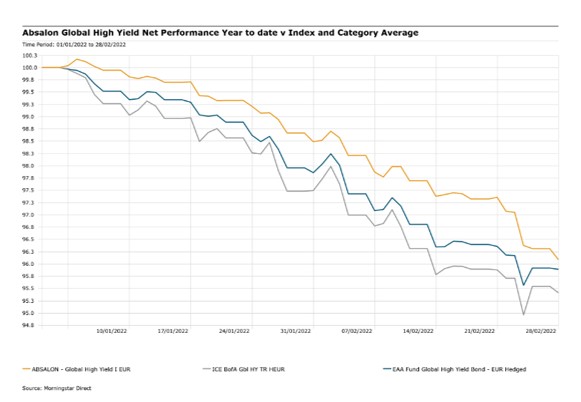

Our key concerns going into 2022 were inflation, rising rates, and potential policy errors from central banks. From a bottom-up perspective, this increased our conviction in companies with natural inflationary hedges such as commodity producers and financials where valuations were already compelling. While the European banking sector has been challenged this year, on the back of the conflict in Ukraine, the remaining positioning in commodities and energy has helped us outperform during the current down-turn.

Our strategy remains unchanged: High conviction selection of undervalued credits.

By actively buying bonds where the spread is too high relative to financial leverage and default risk, we minimize permanent loss of capital, while preserving upside. Despite short higher short-term volatility, this approach helped us outperform through the COVID19 pandemic and beyond.

If you want to learn more about our value approach please feel free to get in touch.

|

Name |

1yr Return |

3yr Return |

5yr Return |

|

Average Global High Yield Manager |

-1.47 |

2.46 |

2.01 |

|

Benchmark: ICE BofA Gbl HY TR HEUR |

-3.07 |

2.54 |

2.21 |

|

ABSALON - Global High Yield I EUR |

-0.39 |

4.04 |

3.18 |

Source: Morningstar Global High Yield (EUR Hedged) Peer Group – Net returns in €

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.