21. april 2022

EM Corporate Debt – Big enough to be considered a standalone asset class?

By The Corporate Credit Team

Investors can improve the risk/return profile of their Emerging Market Sovereign Fixed Income portfolios by including EM Corporate Bonds. Diversification will increase, rate sensitivity will fall, and the Information Ratio should rise as it has done historically.

Key takeaways

- EM Corporate Debt market offer strong risk-adjusted returns

- EM Corporate Debt market is now larger than the US HY market, well diversified across countries, issuers, and sectors.

- Sovereign Rating constraints punish strong companies in weak economies which can be exploited to increase the return potential without increasing the default expectations.

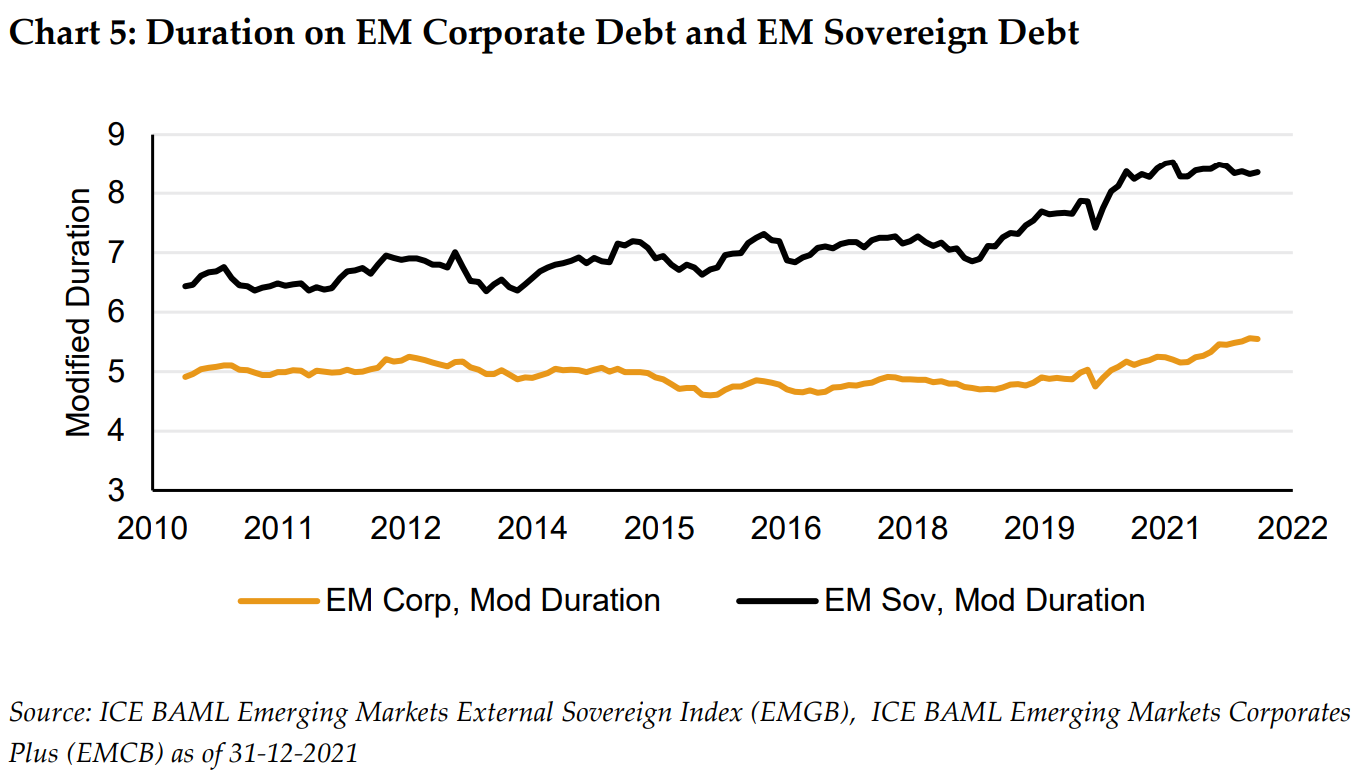

- Lower rate sensitivity. Corporates normally issue shorter dated bonds which combined with higher coupons results in lower duration and therefore less sensitivity to rising rates.

- Absalon EM Corporate Debt’s active value approach has produced outperformance

Better return, lower volatility

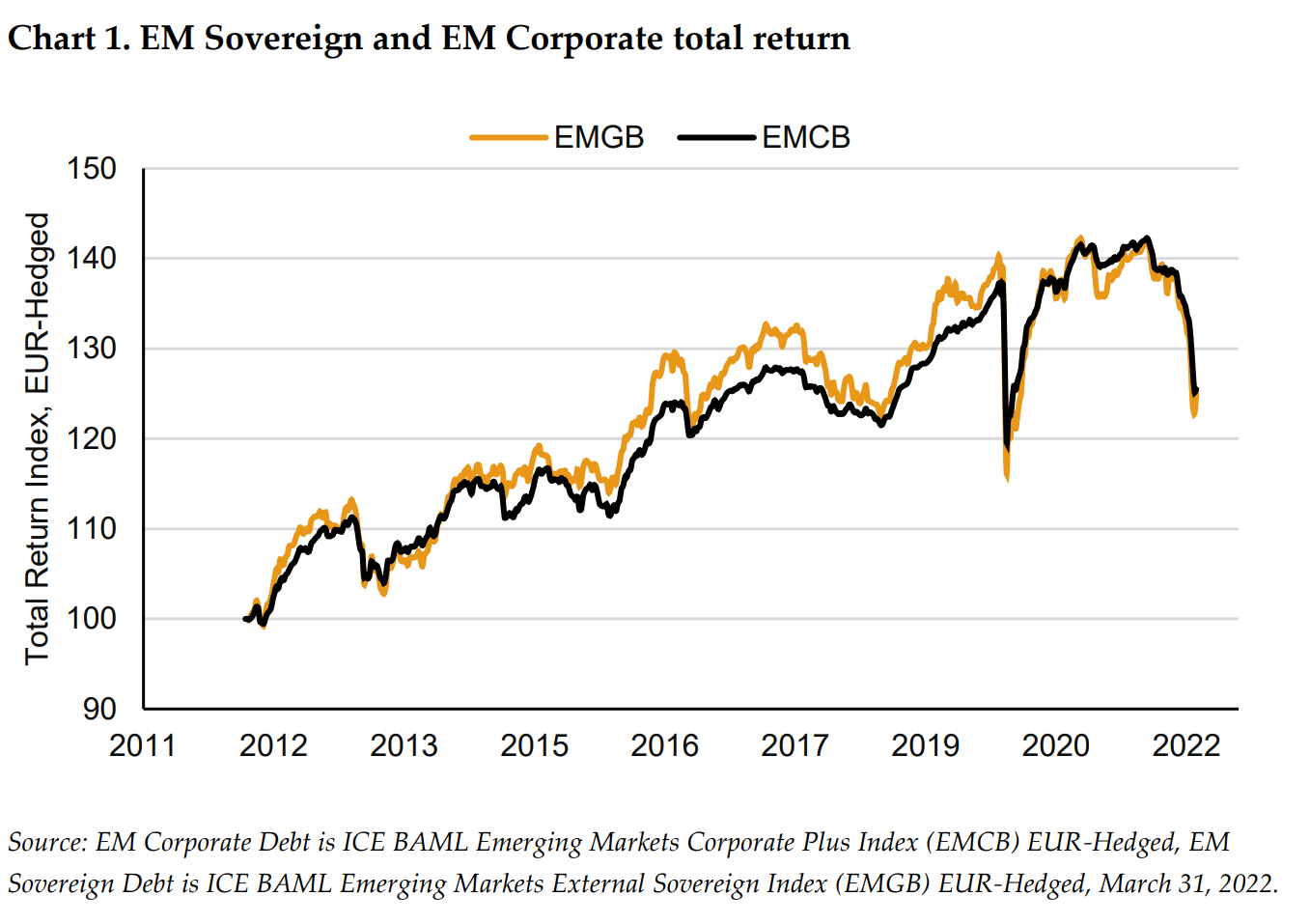

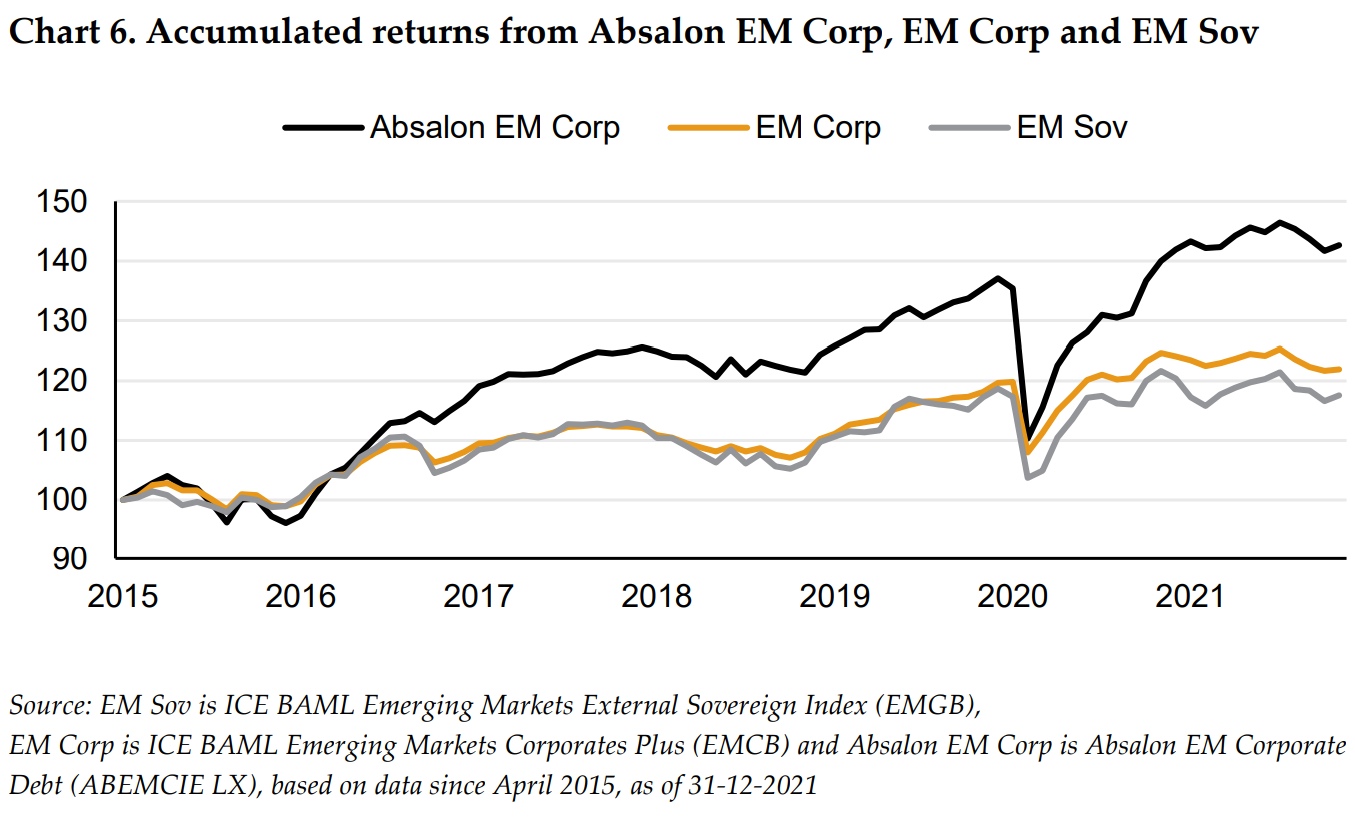

Historically EM Sovereign debt and EM Corporate debt returns have been highly correlated making the assumed more liquid and mature Sovereign market the preferred asset class for investors to gain EM fixed income exposure.

However, during the last decade EM Corporate Debt has outperformed both Hard and Local Currency Sovereign Debt. Not only have investors been able to obtain higher returns from EM Corporate debt - they have also gained the higher return with less volatility. Historically standard deviation on EM Corporate Debt and EM Sovereign Debt has been 5.5% and 7.2%, respectively. Beta on EM corporate Debt has been around 0.7 compared to EM Sovereign Bonds.

Source: EM Corporate Debt is ICE BAML Emerging Markets Corporate Plus Index (EMCB) EUR-Hedged, EM Sovereign Debt is ICE BAML Emerging Markets External Sovereign Index (EMGB) EUR-Hedged, Monthly returns from 2015 to ultimo 2021. Beta regression is EMCB = 0.7186x+0.001, R2 =0.8617, with x=EMGB.

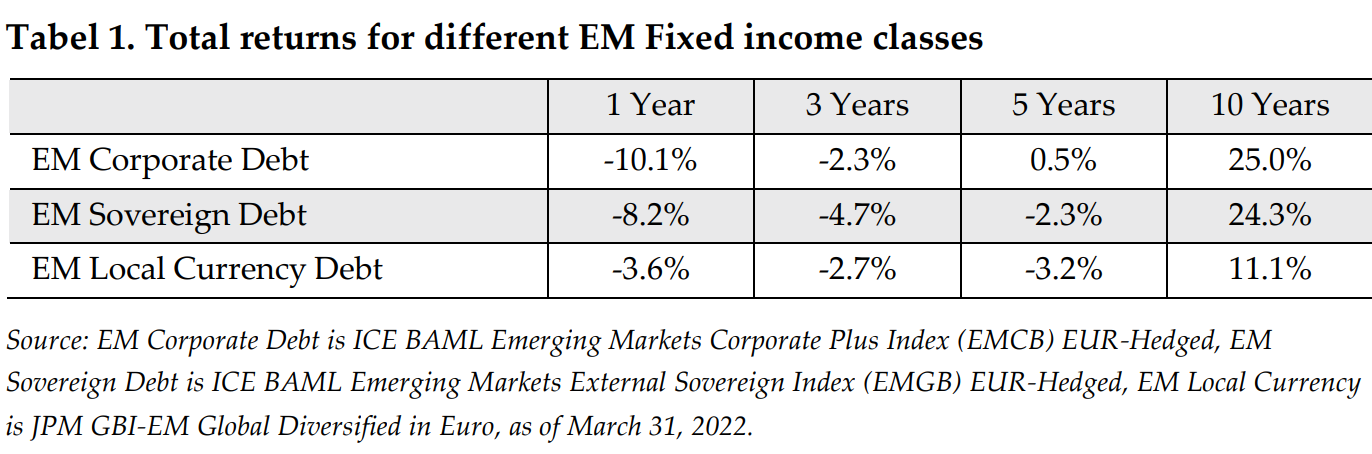

The lower volatility is a product of many factors. Firstly, investors not only get exposure to bonds with a similar level of yield but with a substantially lower duration. Secondly, the average credit quality for corporates measured by ratings has historically been higher and with a smaller tail of poor credits keeping defaults at low levels. Therefore, volatility adjusted returns have been better for EM Corporate debt.

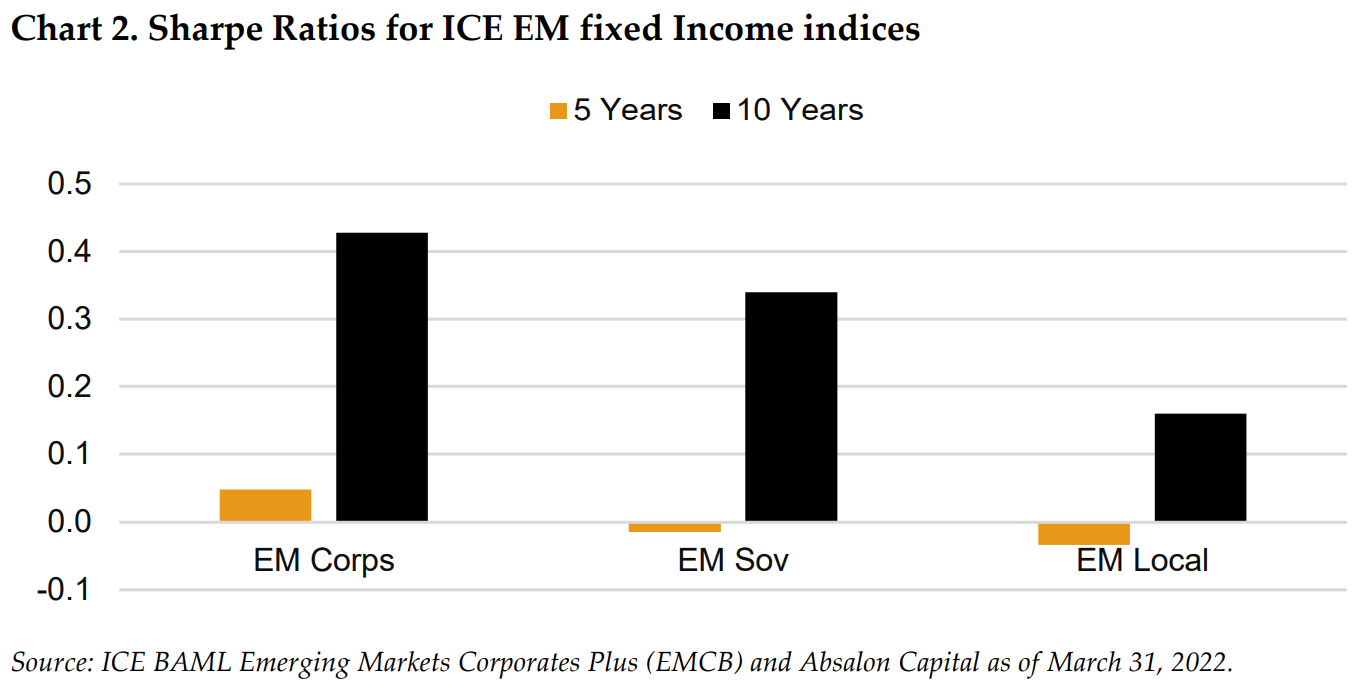

Examining the Sharpe Ratios for EM fixed income assets, EM Corporate Debt market has generated a significantly better Sharpe Ratio relative to EM Sovereign Debt and EM Local Currency markets. EM Corporates offer the strongest risk-adjusted returns historically over 5 or 10 year periods. Lower duration and greater diversification across sectors may explain the lower downside risk in highly volatile periods.

EM Corporate Debt has matured into a standalone asset class

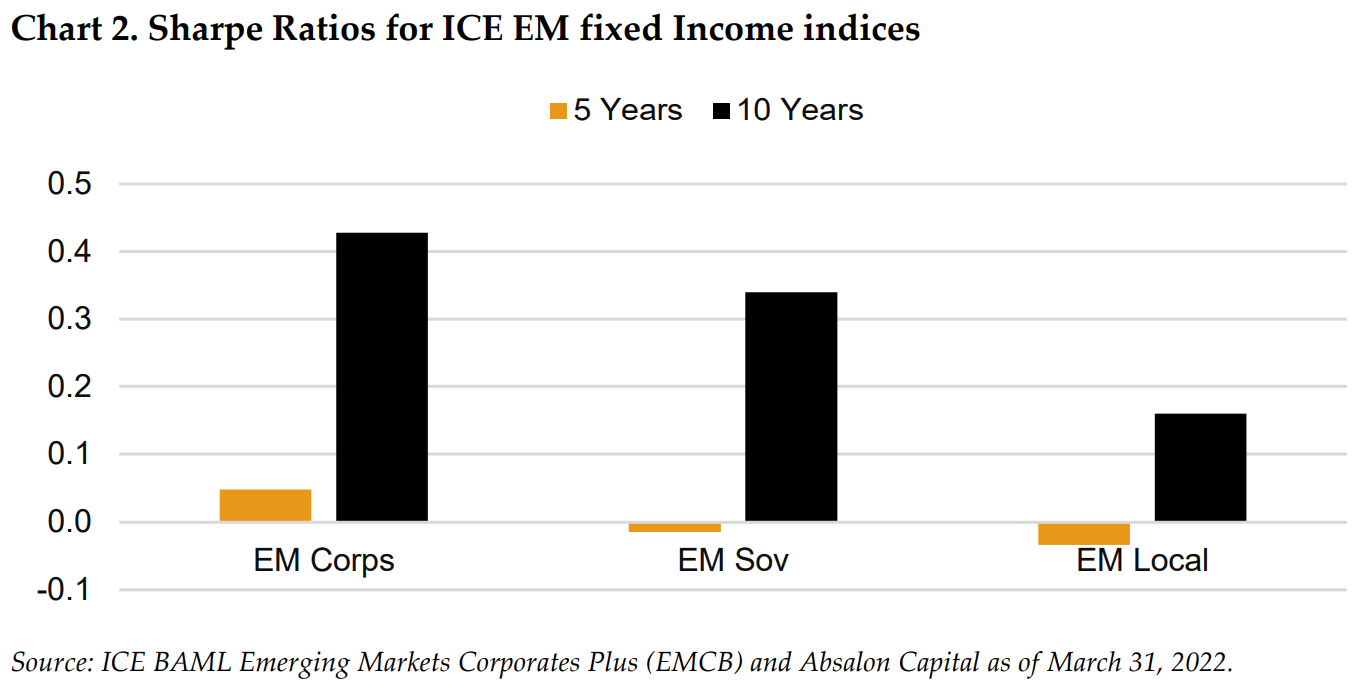

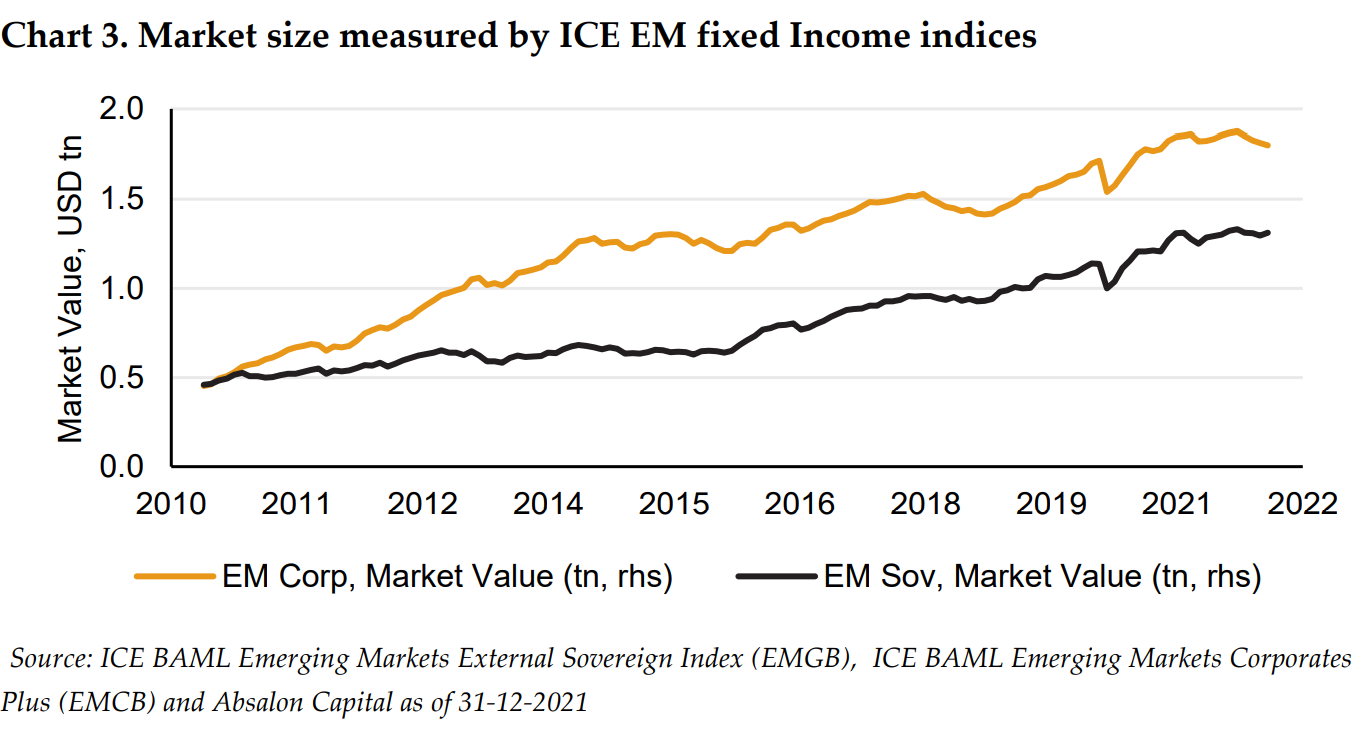

Much has changed since we launched our EM Corporate Debt strategy back in October 2010. Back then, the EM Corporate Bond market was similar in size to the EM Sovereign Bond market. Over the last decade Emerging Market economies have experienced significant growth and corporates have diversified their funding strategies away from a reliance purely on bank loans to include bond issuance. This has dramatically increased the overall size of the EM corporate bond market. Today the EM Corporate bond market is almost 50% larger than the EM Sovereign bond market.

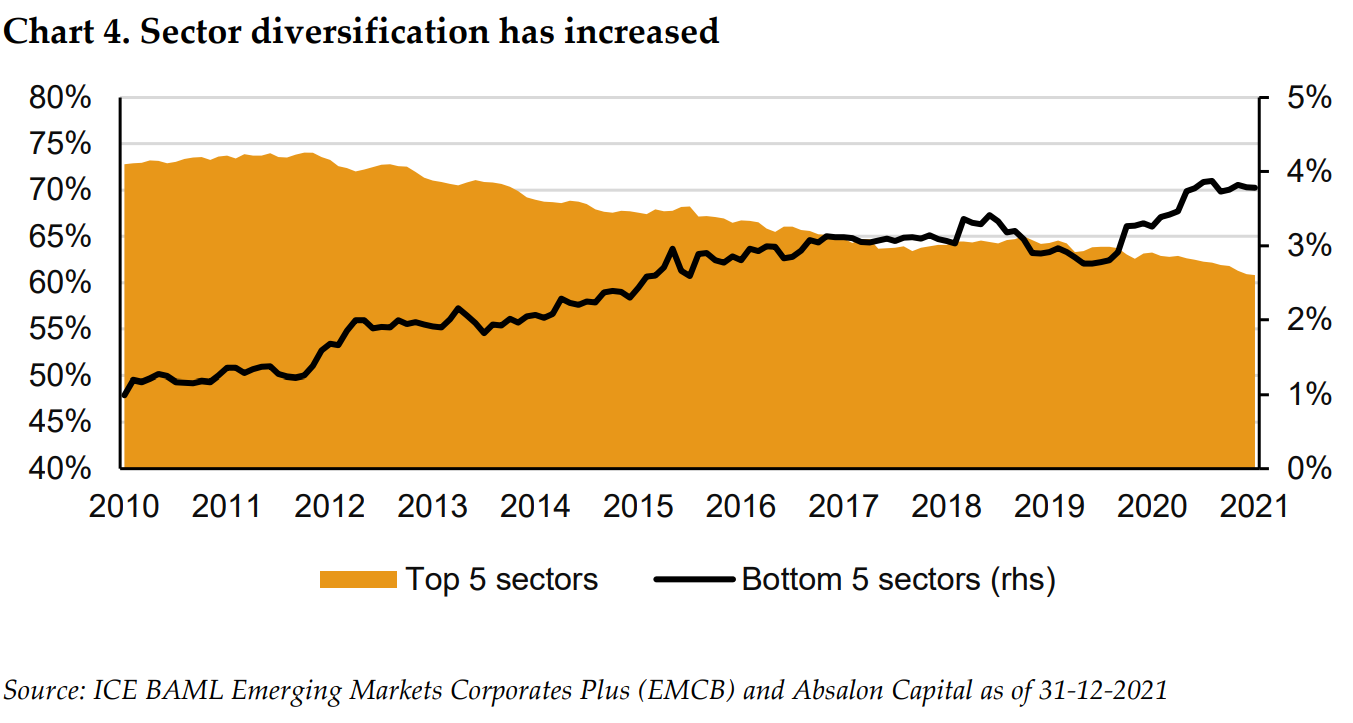

The growth of the overall EM Debt market and the growing acceptance of the asset class has increased diversification across multiple measures. Larger corporates have multiple issues spread across different maturities and diversification has increased across sector and geography. Since 2010 the top 5 sectors made up close to 75% of the index. Today this figure has fallen to 60%. The bottom 5 sectors have over the same period increased from sub 1% to about 4% today – an even larger percentage if the numbers are adjusted for quasi sovereign and agency issuers.

The EM corporate debt market today is larger than the US High Yield market both in terms of the number of underlying bonds and the number of issuers, although diversification across sectors is slightly more concentrated in EM – as an example Energy is more concentrated in EM Indices with weights over 20% compared to roughly 11% in the US High Yield market. Nonetheless, this does not change the fact, that EM Corporate debt markets today are larger and more diversified making it easier for active managers and investors to achieve the preferred risk profile.

The diversification benefits on a standalone allocation to EM Corporate debt become even more evident when compared to Sovereign Indices. The number of issuers is 10 times higher with three times as many underlying bonds, giving asset allocators a broader opportunity set. Furthermore, investors can invest in strong companies in poor economies whereby the geographic diversification can be maintained without compromising the default risk.

Many EM Frontier countries were already in a precarious funding state prior to the onset of COVID-19, today these countries are facing additional headwinds with increasing food and energy prices that will accelerate government debt spending and growing debt burdens. We would expect to see more countries struggling to refinance without the help of either the IMF, World Bank, or bilateral agreements. Over the last decade, EM Frontier countries have been very active issuing hard-currency sovereign debt, whereas there are hardly any corporate bonds issued out EM Frontier countries. Given the current default forecasts for EM Corporate Debt to remain low (even accounting for the likely rise in Chinese Real Estate defaults), we do not believe EM Corporate investors will face similar hurdles in the short/medium term.

Robustness to rate hikes

Over the last decade we have seen a sharp rise in the duration of EM Sovereign Debt, from 6.3 to 8.4, even though the average rating for the asset class has remained stable. A much lower change is evident when analyzing EM Corporate Debt where duration has only marginally increased from 4.8 to 5.5. This lower duration combined with a larger coupon has also helped to mitigate the negative effect on total returns from rising US rates. During January 2022 US Treasury 10-year rates increased more than 25bps. The impact on returns within the investment grade subindices for corporates and sovereigns clearly shows the rate sensitivity differences. EM Corporate Debt IG returns in January 2022 fell by -1.98% whereas the longer duration EM Sovereign Debt IG declined -3.70% over the month.

Value Investing in EM Corporate Debt continues to deliver solid results

Since the inception of our strategy in 2010 we have followed an unconstrained approach with a strong value bias. Our credit selection is driven by bottom-up fundamental research focused on identifying value opportunities from across the entire market. We think one of the benefits of this unconstrained approach is our ability to access less well covered names, often in out of favor countries and sectors.

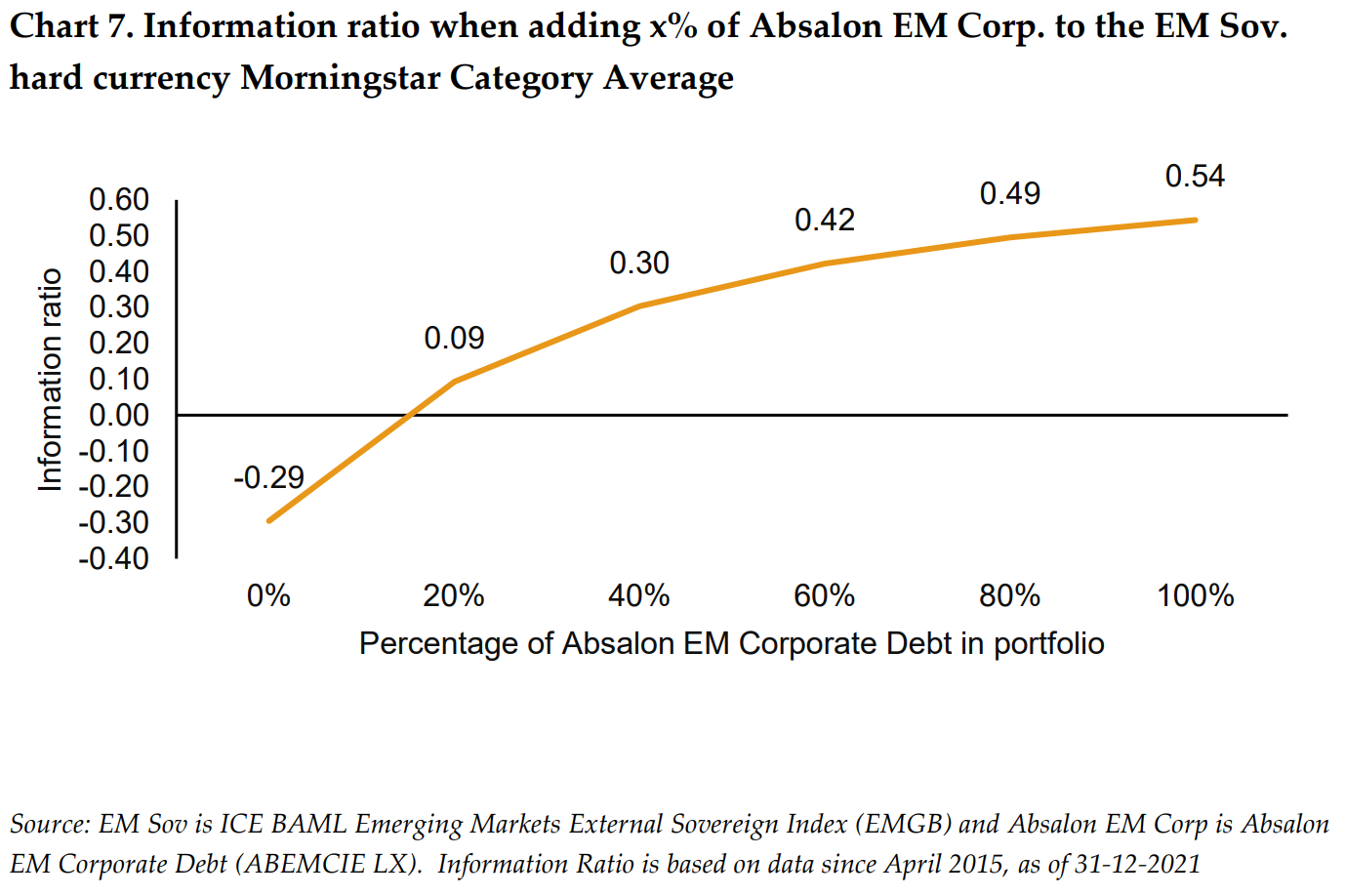

EM Corporate Debt is still viewed as a smaller and therefore less important asset class, with investors happy to outsource the blending of Sovereign and Corporate Debt to their appointed manager. Over time we believe this will change, as investors become more familiar with the benefits of the EM Corporate Debt asset class. In Chart 7. we show that by substituting some of the EM Sovereign Debt investment to Absalon EM Corporate Debt fund an investor would potentially increase their Information Ratio substantially.

Conclusion

We continue to believe that investors would be better served by treating EM Sovereign and Corporate Debt as two distinct asset classes, given the very different drivers of returns. The case for blending both strategies is becoming weaker as the Corporate Debt market continues to develop. Post the pandemic we expect to see a rise in defaults/restructurings in lower quality segments of the Sovereign Debt market. Even with the significant fallout we have already seen in the large Chinese Real Estate market, we believe corporate issuers within Emerging Markets are likely to continue to offer investors a less volatile and ultimately more profitable allocation.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.