16. juni 2021

Well positioned for inflation

By The Corporate Credit Team

Investors are growing increasingly concerned about the likelihood of rising inflation however transitory it might turn out to be.

Key takeaways

- Absalon Global High Yield and Absalon Emerging Market Corporate Debt offer an effective hedge against rising inflation due to their focus on Value

- Higher rates? Credit investments in the Value segments of the market offer less duration risk and more positive correlation to economic growth

- Being active and less constrained by index weights will improve the potential ability to protect portfolios from the effects of higher rates

Higher yields and lower duration should be an effective hedge against rising inflationary expectations

Inflation remains a major concern for investors currently as we digest the growing improvements in economic fortunes globally. Commodity prices are rising, and supply chain issues are causing inflation to pick up. At this juncture investors seem unsure if these are permanent or temporary affects as we start to emerge from lockdown. The secular forces of high debt and ageing populations have not disappeared; they may well reassert themselves once concerns related to the pandemic dissipate.

We know from previous periods of inflation that the more cyclical parts of the global high yield market have performed well in such periods. Large growth orientated equities are theoretically the most sensitive to rates because their cashflows are weighted well into the future and they have clearly led the market lower as inflationary pressures have risen. On the other hand, cyclical high yield sectors associated with the Value factor have held up well due to its correlation with growth and higher commodity prices

Both our global high yield and EM corporate debt portfolios are well positioned for a potential rise in inflation, even if it proves to be transitory. The duration of both strategies is substantially lower than their benchmarks. Our global high yield fund has a duration of just 3.13 years and our EM corporate debt fund’s duration is 2.93 years.

In particular, the asset allocation of our high yield strategy currently has a strong bias to higher growth and reflation. We continue to have a large allocation to Insurance, Banks, Energy and Transportation because of our bottom-up selection. These sectors will all benefit from reopening through tighter credit spreads as reflation follows the reopening. Earnings in both insurance and banking are positively correlated with reflation and higher rates. Insurance companies have a better match of assets and liabilities at higher rates and can offer more attractive products, while the improved carry in investment portfolios will offset some of the initial loss from rising yields.

Banks will see higher earnings from their lending business and lower credit losses related to defaults from the lockdowns. Energy remains supported by the rising price of oil and gas, while Transportation will benefit from increased global activity.

Consequently, our high yield strategy appears very well positioned for inflation in our view. Earnings in cyclical businesses will benefit in a reflation scenario, which will spill into lower credit spreads offsetting some of the rise in risk free rates. As a caveat we would point out that our strategy is not about going all in on risk; we still maintain a higher average rating compared to the benchmark, which we believe will continue to keep our default count significantly below that of the index as it has done in previous cycles.

Looking to emerging market corporate debt, the large weight to investment grade issuers leaves investors potentially more exposed to the effects of rising rates. However, we believe that our emerging market corporate debt strategy with its value focus and lower exposure to investment grade credits will be key to navigating the risk of rising rates. Within the emerging market corporate debt universe, we continue to favor high yield issuers. Our focus on industrials, commodity producers and selective financials will, we believe, benefit from higher rates relative to the index. We also believe that our focus on exporters will continue to deliver inflation protection as exports from EM continue to rise on the back of the global economic recovery and weak local FX markets relative to USD and EUR.

What should investors expect in a rising rate envirnoment?

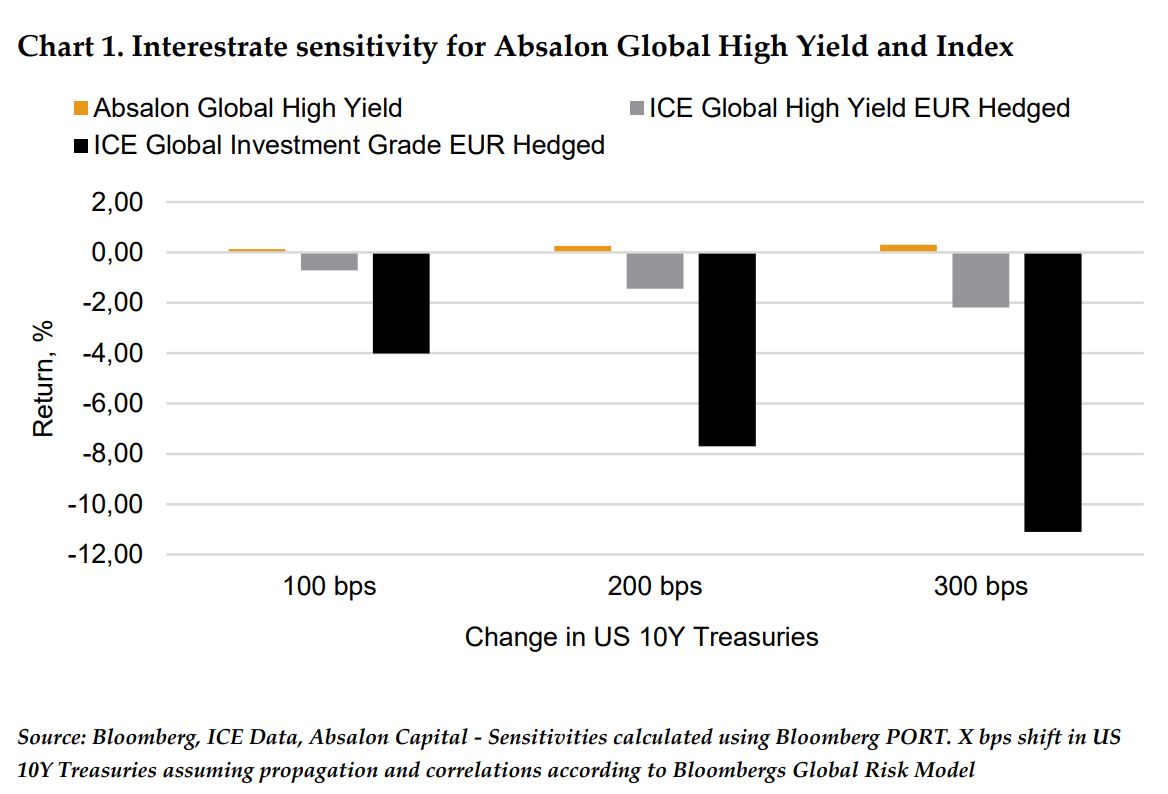

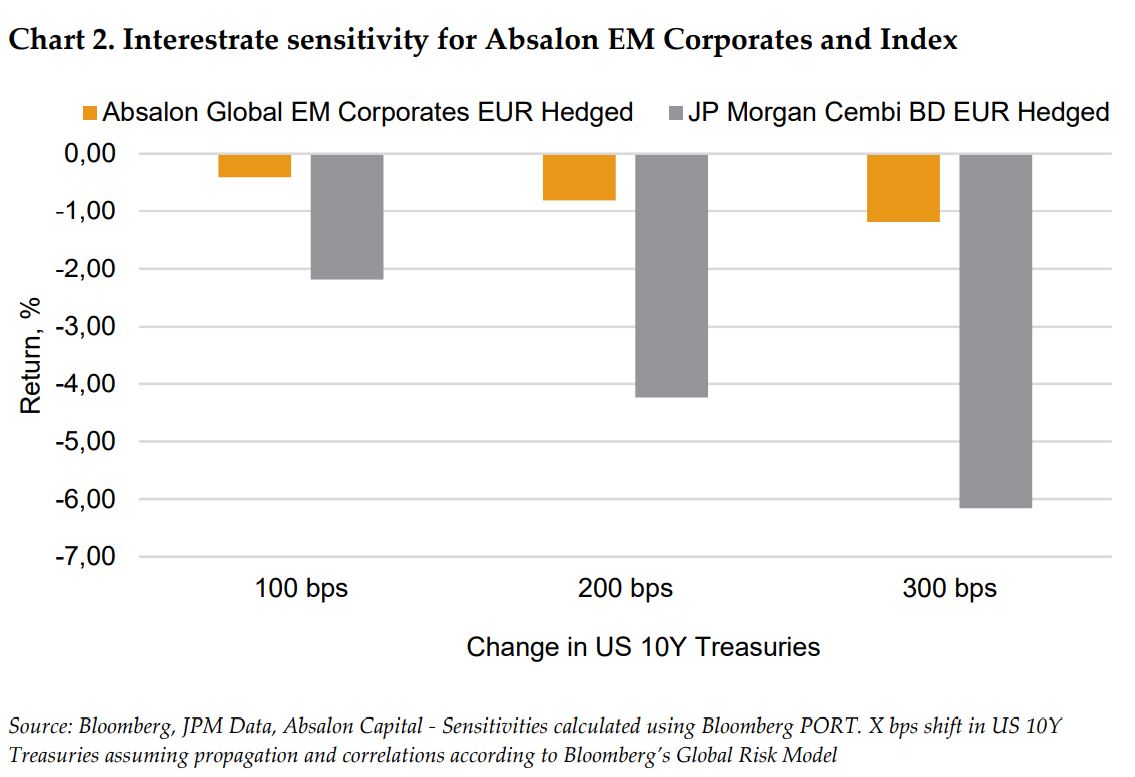

Below we provide a “what if” analysis, to give investors a sense of the return impact of rate increases of different magnitudes. We stress test our portfolios and compare the performance with our reference indices for both strategies. In the case of global high yield we have also included the ICE Global IG index for comparative purposes.

Holders of investment grade paper are naturally most sensitive to increasing rates due to the relatively small credit component relative to rates risk. The global high yield index is relatively resistant to minor increases in rates, but duration has in fact increased since the start of the pandemic due to a wave of downgrades in 2020 and

for larger moves in rates, the historical spread tightening is not sufficient to compensate resulting in negative total returns.

For our global high yield fund, the focus on value and bottom-up sector selection means that returns are actually (slightly) positively correlated with increasing rates. This makes good sense to us given the arguments set out above, but also our historical experience with our strategy which performs very well in improving to stable markets (usually associated with an expanding economy).

Our EM corporate strategy follows a similar value approach. However, EM assets have historically been more sensitive to US interest rates and this correlation implies that the strategy performs slightly worse compared to our global high yield strategy despite a somewhat lower duration. Compared to the benchmark, however, there is clearly a buffer for increasing rates built into our EM corporate strategy.

Conclusion

Inflation is an increasingly important topic for investors globally. Our bottom-up value approach to credit investing allows us to build a portfolio which is very resistant to inflation and rising rates compared to most alternatives within traditional fixed income investments. In a market where there is a distinct lack of clarity surrounding the economic recovery and thereby the path of interest rates, we believe there has never been a more important time to be active and unconstrained.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.