10. august 2021

Selective small cap exposure enhances returns in EM corporate credit

By The Corporate Credit Team

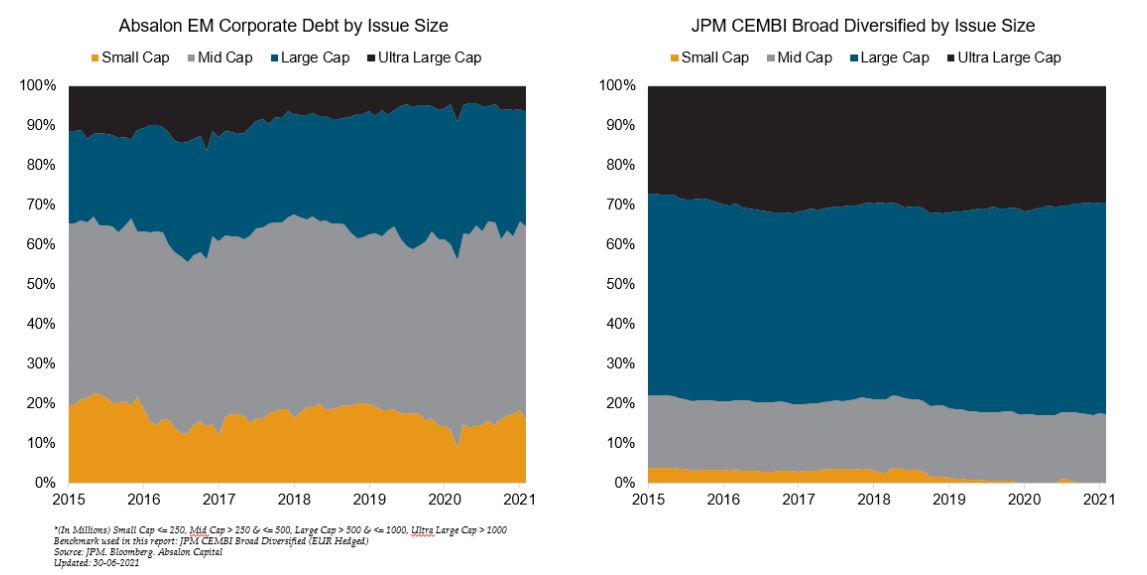

The main EM credit indices are constructed based on the market cap size of an issue. The larger the issuer size, the larger their representation within the index. This often results in highly leveraged issuers representing a significant proportion of these indices. As a value investor we focus on the size of the opportunity not the index weight. Over multiple market cycles since 2010 we have demonstrated that some exposure to small cap enhances long term returns. In this short note we provide an example of a smaller issuer which highlights the opportunities that still exist for active, unconstrained investors.

Key takeaways

- Large index aware funds/ETF have no/minimal exposure to small cap issuers.

- Small cap issuers in EM are less efficiently priced often because of a lack of analyst coverage.

- Small cap issuers typically have less leverage than large caps – the size premium is therefore not obtained from a tilt towards riskier companies.

- The additional spread premium in small cap is still significant even when accounting for the illiquidity risk.

Why size matters

In a previous note entitled “Why size matters” we discussed the benefits of having some small cap exposure. The note highlighted that smaller issuers pay higher spreads for a given level of leverage. In this note we provide a good recent example of one of these small cap issuers in our EM corporate debt strategy.

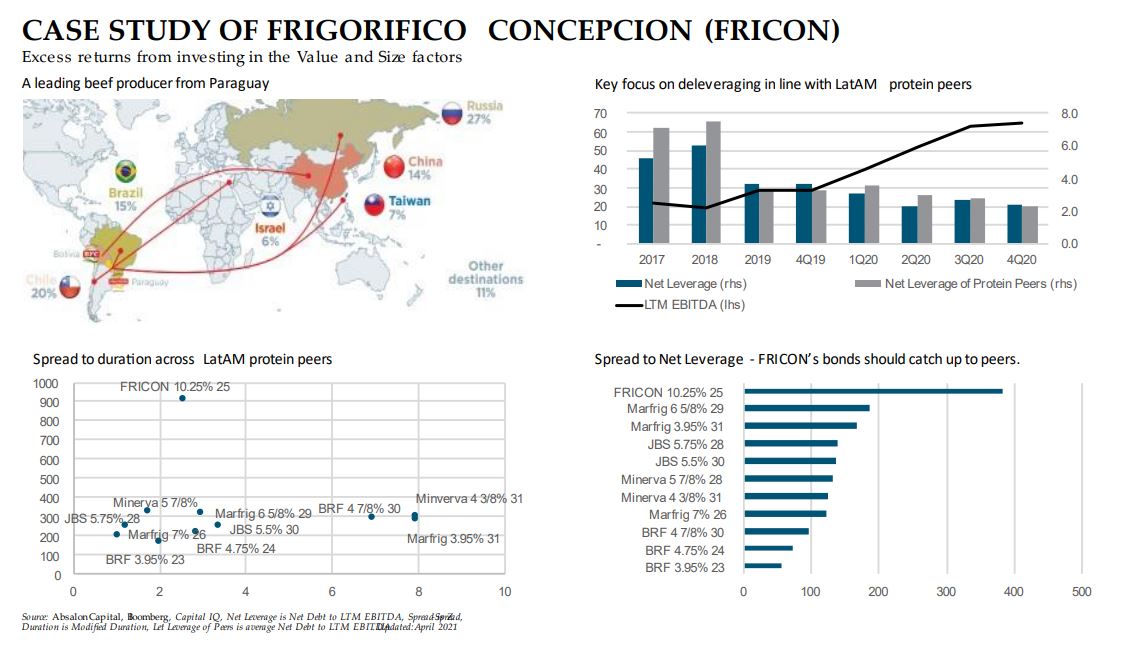

Frigorifico Concepcion

Background - Frigorifico Concepcion is a leading beef producer in Paraguay. The company has strong profitability underpinned by its export platform (90% of its revenues come from exports) and low cost of production. The company is expanding in Bolivia which provides exposure to the fast-growing Chinese market. Net leverage is low at 2.0x and the company remains committed to maintaining net leverage at no more than 3.0x.

The company issued a small 5-year bond – just 100mio USD - at a yield of 10.5% back in January 2020. Subsequently the company issued an identical bond of about 61mio USD. These bonds have traded at stable levels around par since they were issued. In early July 2021 the company tendered the bonds at a price of 112. The company’s intention was to finance the tender with a new bond issue. Recently, the company managed to issue 300mio (still relatively small issue size) at a yield of 8%. We believe this example of an off-benchmark opportunity illustrates that it is not necessarily riskier from a default perspective. The company is being forced to pay a higher spread in part because of the lack of focus from constrained managers and passive products (ETF etc).

With spreads narrowing back to pre-COVID levels over recent months we believe that selecting off-benchmark issuers which are inefficiently priced is a better option than investing in fundamentally weak overleveraged companies. With the short end of the yield curve well anchored by developed market central banks and a large amount of negative yielding debt, the refinancing risks for smaller issuers remains contained for now.

The chart below illustrates the size distribution for J.P. Morgan CEMBI Broad Diversified Index and Absalon EM Corporate Debt strategy since 2015. It clearly demonstrates that the Absalon EM Corporate Debt strategy is tilted to Small Caps through time, whereas the Small Cap index weight is limited. Over the previous 11 years we have been able to harvest opportunities in small cap issuers driven primarily by our value focus and unconstrained approach to investing in EM corporate debt. We do not believe that this phenomenon will change.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.