17. januar 2021

Absalon Emerging Market Corporate Debt

By The Corporate Credit Team

An allocation suitable for an uncertain world.

Benefits of Emerging market corporate debt (Hard Currency)

- Shorter duration – JPM CEMBI duration 4.7 yrs, JPM EMBIG 8.7 years, Absalon EMCD 2.2yrs

- Larger universe – 719 hard currency corporate issuers versus 168 sovereign issuers

- Less tail risk - less exposure to CCC+ and poor-quality Frontier countries in hard currency corps

- Lower forecasted default rates - (JP Morgan forecast EM HY default at 2% v Sovereign HY 6.5% in 2021)

- High recovery rates compared to US HY – recovery rates have remained stable in EM HY but have deteriorated markedly in US HY

- Less leverage - although leverage has risen during 2020 on a spread per turn of leverage basis EM Debt still offers greater reward

- Attractive technicals - less issuance/strong inflows

With more than 80% of global sovereign debt now yielding less than 0.5% there is an obvious lack of income generating opportunities for investors. With rates at such low levels a mild pick-up in inflation as we have witnessed over the last couple of months has had negative consequences for duration sensitive assets like sovereign and investment grade corporate debt.

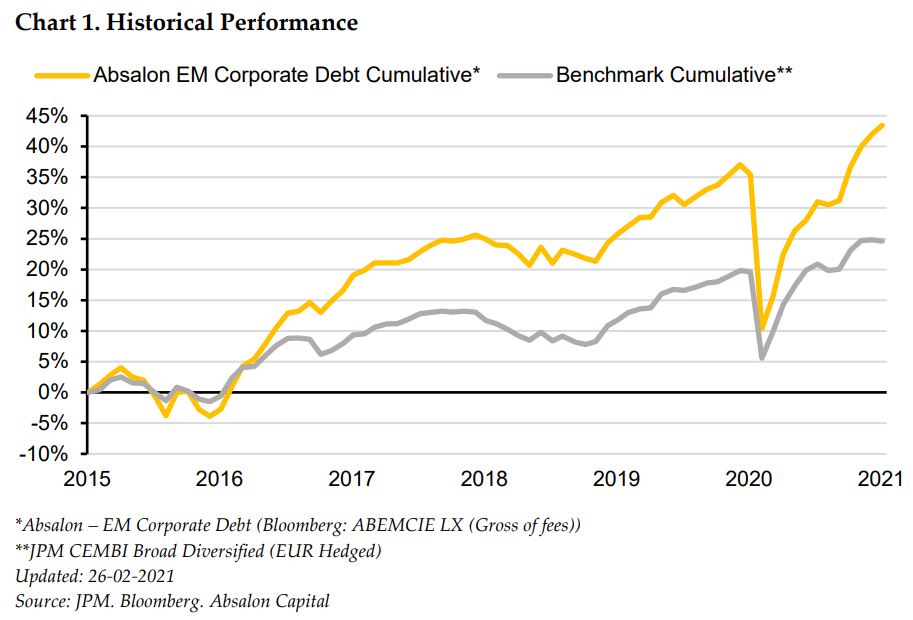

We believe emerging market corporate debt (hard currency) has some notable advantages over sovereign and local currency corporate debt given the market backdrop we face at the start of a new year. With investment grade spreads compressing back to levels seen at the start of 2020 and some areas of the high yield market also looking fully valued we think the easy money has been made. Going forward the benefit of an active, unconstrained value focused approach will allow investors to capture opportunities across the entire market, irrespective of rating, geography, or sector. As a value investor we offer a high yielding portfolio - 6.2% versus 3.4% for JPM CEMBI BD. Historically we have been able to limit permanent loss of capital by keeping defaults below the benchmark, while collecting the excess carry. Our skew towards high yield also means lower duration risk - currently around 2.2 years. Our focus remains identifying cheap, out of favour bonds which do not employ excessive leverage. When we compare our current portfolio, we have an average ratings two notches below the index, BB versus BBB-. Yet, we offer a spread per turn of leverage of 155bps versus 92bps for the index. We would also note that while the recovery from last March has been dramatic, it has remained focused in the large/mega cap issuers within emerging markets. We believe that given our value approach, the portfolio contains many undervalued bonds which the market has yet to recognise.

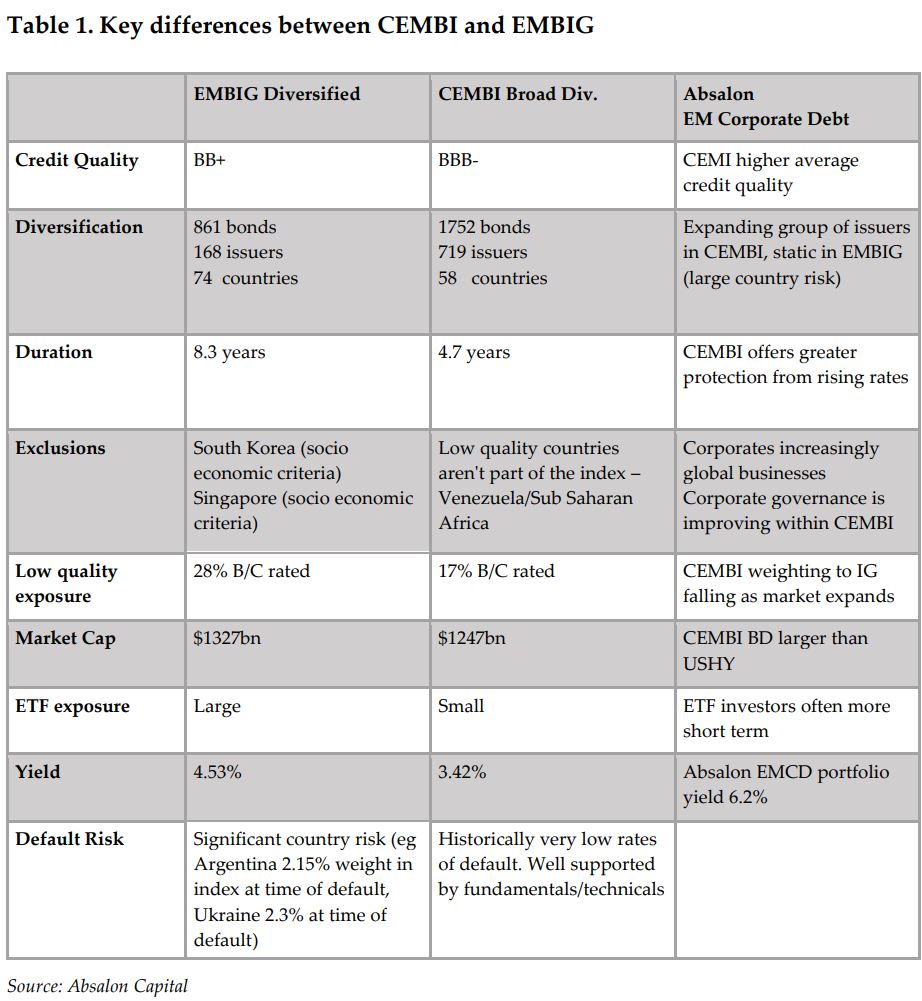

Having experienced multiple shocks to individual markets and regions over the past 15 years we believe our ability to identify attractive value opportunities in often very unloved countries will continue to deliver for investors, especially those looking for a genuinely active, high conviction value orientated approach. Below we highlight some of the key differences bet ween the two main indices offered by JP Morgan – JPM CEMBI Broad Diversified and JPM EMBIG Broad.

Disclaimer

The above information is marketing material and has been provided for information purposes only. The information cannot be considered as financial advice or as an offer of any other investment advice. It is recommended that the investor contacts their own investment adviser for individual information about a potential investment, tax conditions et cetera before the purchase or sale of securities. Please note that past performance is no guarantee of future performance. The information was obtained from sources, we believe to be reliable, however we cannot assume any guarantee for its accuracy or completeness.

Investment decisions should be based only on the current Sales Documents (Key Investor Information Document – KIID), Sales Prospectus and Articles of Association and, if published, the most recent annual and semi-annual report). The Sales Documents are available free of charge from the custodian bank (Brown Brothers Harriman) or the Investment Management company Universal-Investment- Luxembourg S.A. (www.universalinvestment.com) and the distribution partners.